Aura Core Income Fund

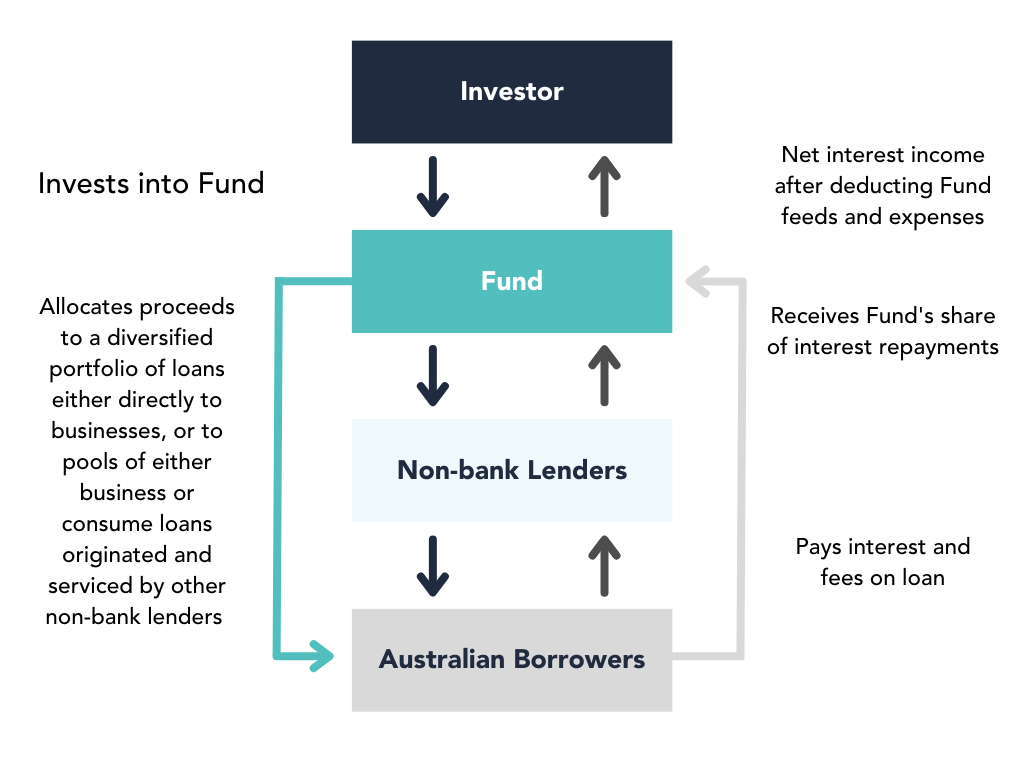

The Aura Core Income Fund aims to invest into a diversified pool of Australian private debt investments. Investments will be made via warehouse securitisation deals, notes or other instruments for business and consumer loans, as well as direct lending to businesses.

About the Fund

The Fund’s primary objective is to focus on preservation of capital as a first order of concern, followed by the provision of stable monthly cash income, and portfolio diversification by providing exposure to a portfolio of private debt assets.

The Fund aims to achieve a Target Return of the Reserve Bank of Australia (‘RBA’) Cash Rate plus 3.5–5.5% per annum net of fees and costs, through the economic cycle. The Fund’s total return may rise, or fall based on, amongst other things, performance in the underlying loan assets and on movements in the RBA Cash Rate. The Fund’s Target Return is only a target, and the actual return of the Fund may be lower than the Fund’s Target Return.

The Fund aims to invest in a diversified pool of Australian private debt investments. Investments will be made via warehouse securitisation deals, notes or other instruments for business and consumer loans, and direct lending to businesses. The Fund will target private debt investments sourced from multiple channels, including:

- Investing in the funding vehicles of loan originators targeting well-secured loans with a low probability of default, aiming to achieve higher returns on a risk-adjusted basis than publicly traded notes of similar portfolio default and loss given default levels.

- Direct business lending opportunities.

- Consumer lending via warehouse securitisation vehicles.

- The Fund provides an opportunity for investors to benefit from the Investment Manager’s experience and extensive research and proprietary due diligence processes to target high quality Australian non-bank lenders.

Our competitive advantage is that Aura Group had the first movers’ advantage in the private debt SME lending market via our initial wholesale investor client only Aura High Yield SME Fund (AHYSME). Through establishing the AHYSME Fund, the portfolio manager has developed an extensive research and proprietary due diligence process to target high-quality Australian non-bank lenders. The AHYSME Fund has a track record of successful investment within Australian SMEs, as well as the provision of funding to lending businesses. The Aura Core Income Fund provides an opportunity for investors to benefit from that experience via an established retail fund.

The Fund’s investment strategy is to provide stable monthly cash income and portfolio diversification by gaining exposure to the private debt asset class.

The following portfolio parameters have been set for the Fund:

- 0 – 90% invested into private debt assets.

- 5% maximum loan concentration to a single underlying loan, once the funds under management within the Fund reaches $100m.

- 10 – 100% cash holdings.

The Fund is able to use derivatives to hedge interest rate risk.

| 1 Month | 3-Month | 6-Month | 1-yr p.a. | 2-yr p.a. | Since Inception (p.a.) | Since Inception (cum) | |

|

ACIF |

0.54% | 1.76% | 3.44% | 7.13% | 7.51% | 7.34% | 24.31% |

|

RBA Cash Rate |

0.31% | 0.91% | 1.89% | 4.05% | 4.24% | 4.04% | 12.96% |

Returns are net of fees, and assumes reinvestment of distributions.

Past performance is not a reliable indication of future performance. Inception date 4 October 2022.

How does the Fund work?

The Fund is offered under a Product Disclosure Statement (PDS) and is an open-ended unit trust that is an Australian registered managed investment scheme.

Applications are processed monthly, provided your complete application monies are received and accepted before 12 noon Sydney time on the second last Business Day of the month.

Due to the Fund’s investment strategy, the Fund is defined as illiquid by the Corporations Act 2001 and there may be periods where an investment in the Fund cannot be redeemed. Redemption requests can only be submitted in response to Withdrawal Offers made by the Responsible Entity. Refer to Section 7 of the PDS for further information.

-

Eligible Investors

-

Type & Frequency

-

Minimum Funds & Redemption Period

-

Fees

The Fund is aimed at retail and wholesale investors. Participation is available to individuals, companies and trusts, including superannuation trusts so long as applicants are ordinarily residents of Australia and are aged 18 years or over.

The Fund has a minimum investment of A$25,000. We aim to make redemptions available on a monthly basis, subject to available liquid assets that will be notified to investors in a Limited Withdrawal Offer issued by the Responsible Entity. Redemption requests cannot be guaranteed and may not be available every month. Please refer to Section 7 of the PDS.

How to Apply

Thank you for your interest in the Aura Core Income Fund.

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Fund before making any decision about whether to acquire, or continue to hold, an interest in the Fund. Applications for units in the Fund can only be made through an online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from the responsible entity: www.oneinvestment.com.au/auracoreincomefund.

Is this fund suitable for me?

The Fund is aimed at retail and wholesale investors and participation is available to individuals, companies and trusts including superannuation trusts so long as they are ordinarily resident in Australia and aged 18 years or over.

This product is likely to be appropriate for a consumer seeking capital preservation or income distribution, to be used as a core component or satellite/small allocation within a portfolio where the consumer:

- Has a short, medium, or long-term investment timeframe.

- Has a low, medium, high, or very high risk/return profile.

- Does not require monthly access to capital.

The Fund is open-ended and an Australian Registered Managed Investment Scheme offered under a Product Disclosure Statement and registered with ASIC.

What is the Fund's investment objective?

The Fund aims to achieve a target return of 3.5%–5.5% per annum above the Reserve Bank of Australia (RBA) Cash Rate distributed as stable monthly income from a diversified portfolio of Australian private debt assets, predominantly made up of small to medium enterprise loans.

Where does the Fund invest?

The Fund aims to invest in a diversified pool of Australian private debt investments. Investments will be made via warehouse securitisation deals, notes or other instruments for business and consumer loans, as well as direct lending to businesses. The Fund will target private debt investments sourced from multiple channels, including:

- Investing in funding vehicles of loan originators who target well-secured loans with low probability of default and aim to achieve higher returns on a risk-adjusted basis, than publicly traded notes of similar portfolio default and loss given default levels;

- Direct business lending opportunities; and

- Consumer lending via warehouse securitisation vehicles.

The Fund provides an opportunity for investors to benefit from the Investment Manager’s experience and extensive research and proprietary due diligence processes to target high-quality Australian non-bank lenders.

The Fund’s investment strategy is to provide stable monthly cash income and portfolio diversification by gaining exposure to the private debt asset class. The following portfolio parameters have been set for the Fund:

- 0–90% invested into private debt.

- 5% maximum loan concentration to a single underlying loan once the funds under management within the Fund reaches $100 million.

- 10–100% cash holdings.

The Fund is able to use derivatives to hedge interest rate risk.

The Fund invests across the Australian private debt universe, primarily in pools of both Australian SME business and consumer loans, originated by non-bank lenders. The criteria are as follows:

- The underlying exposures are Australian loans.

- There are processes for robust credit assessments of the underlying borrowers.

- The lender has a scalable business model with a robust medium-term outlook to ensure the debts will be originated and serviced to a high standard on an ongoing basis.

- The lender’s management team has a proven track record.

What is the minimum initial investment?

The minimum investment is $25,000 and the minimum client balance is $5,000.

Additional applications (top-ups) of $5,000 or more can be made into the Fund. The minimum additional investment amount does not apply to reinvestment of distributions, which may be lower than this minimum. Additional investments are accepted every month and will be processed on the first business day of each month (provided your additional application is received before 12 noon Sydney time on the second last Business Day of the preceding month.)

How often is income paid?

The net asset value of the Fund will be determined monthly, and the Fund intends to distribute net income to investors each month. It is intended that all net income at the end of each month will be distributed to investors by the 10th business day of the following month and may be slightly delayed after 30 June each year.

Is there a distribution reinvestment plan available?

Yes, you can elect to take distributions as follows:

- Direct deposit to a bank account in the name of the entity investing; or

- Reinvestment in the Distribution Reinvestment Plan 'DRP'. If no election is made on your application form when you invest, then distributions will automatically be reinvested in the DRP.

How do I redeem funds?

The Fund intends to offer monthly redemptions, known as a Limited Withdrawal Offer.

However, please note the Fund is defined as illiquid under the Corporations Act, and regular Limited Withdrawal Offers are not guaranteed and will be subject to the Fund having available liquid assets. The Fund will aim to hold some cash to meet monthly redemptions but there may be situations where limits to redemptions may apply.

Each month, the Responsible Entity intends to offer investors a Limited Withdrawal Offer. During the withdrawal period, the Responsible Entity will accept withdrawal requests.

Investors will be required to submit the Withdrawal Request Form and have it signed by the authorised signatories on the account. The Withdrawal Request Form will be included in each Limited Withdrawal Offer.

Each Limited Withdrawal Offer will be available for acceptance for at least 21 days. You can find details of the withdrawal period on the Responsible Entity One Managed Investment Funds website.

If total redemption requests received are in excess of the amount of the Limited Withdrawal Offer, the requests will to be satisfied proportionately.

Any requests for withdrawal in response to a Limited Withdrawal Offer that are not wholly satisfied due to a scale back will remain valid for withdrawal in the next Limited Withdrawal Offer.

Withdrawal proceeds will be paid to your nominated bank account and generally by the 10th Business Day of the following month. However, the Responsible Entity has up to 21 days to pay withdrawal proceeds.

Please refer to Section 7 of the PDS for more information regarding Limited Withdrawal Offers. You can access the PDS here: Download the Aura Core Income PDS.

Disclosure

The Aura Core Income Fund is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564) (Montgomery) is the authorised distributor of the Fund. As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Fund before making any decision about whether to acquire, or continue to hold, an interest in the Fund.

Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained at www.oneinvestment.com.au/auracoreincomefund.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given for Wholesale Clients only (as defined in section 761G of the Corporations Act 2001) and is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.