Aura Term Deposit Fund

The Aura Term Deposit Fund provides investors with exposure to an actively managed portfolio of Australian term deposits, cash and cash equivalents issued by Australian Authorised Deposit-Taking Institutions regulated by APRA.

About the Fund

The Aura Term Deposit Fund aims to provide investors with capital stability and liquidity. The Fund also aims to provide a total investment return (before fees) that outperforms the RBA Bank Accepted Bills 90 Days monthly average rate. The Aura Term Deposit Fund provides investors with exposure to an actively managed portfolio of Australian term deposits, cash and cash equivalents issued by Australian Authorised Deposit Taking Institutions regulated by APRA.

The Aura Term Deposit Fund aims to actively manage counterparty and liquidity risk on behalf of its investor base, whilst striving for a gross return in excess of the RBA Bank Accepted Bills 90 Days monthly average rate and a positive net return. The Aura Term Deposit Fund seeks to build a reputation for providing capital stability, risk mitigation and achievement of its return targets for its investors over the short to medium term and act as a market leader as rates increase over the medium to long term.

The portfolio achieved an annualised net return of 3.56% for January 2026. We maintained a highly liquid portfolio with short duration term deposits and cash, making up the portfolio.

|

Gross Yield to Maturity (running yield as at 31 January 2026)

|

4.04% p.a.

|

|

Annualised Net Return for January 2026

|

3.56% p.a.

|

|

Simple Return Since Inception (cumulative as at 31 January 2026)

|

12.82%

|

|

Average Duration (as at 31 January 2026)

|

32 days

|

Data as at 31 January 2026.

Past performance is not a reliable indicator of future performance. Capital stability and positive returns are not guaranteed. Inception date of the Fund is 14 July 2022. Returns data is after fees and assumes reinvestment of distributions. Annualised return is not intended as a forecast, nor guarantee, and is subject to change.

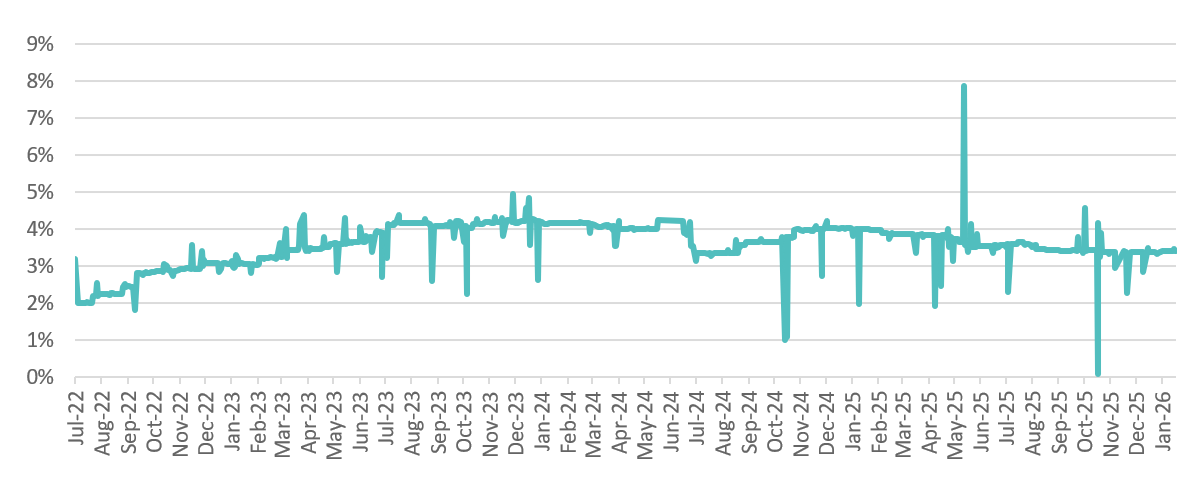

Annualised Net Return (as at 31 January 2026)

An actively managed portfolio of Australian term deposits and cash

Target Yield above RBA Bank Accepted Bills 90 day monthly average rate

Allows investors to gain exposure to future interest rate rises

Saves investors time chasing rates and tracking maturities from different banks

-

Eligible Investors

-

Type, Frequency & Target Return

-

Minimum Funds & Investment Period

-

Fees

-

Redemption

The Aura Term Deposit Fund is an open-ended fund that provides monthly distributions with a target yield above the RBA Bank Accepted Bills 90 Day monthly average rate.

A$500,000or a lesser investment amount for wholesale and sophisticated investors as defined by the Corporations Act 2001.

Management Fees: Lesser of 0.50%p.a. or 20% of total investment return for the day, net of all other fees and expenses1

Estimated to be 0.11% p.a. on $100m FUM Fund size2

1) Calculated on a daily basis and accrued into the unit price of the Fund. The 20% investment return will be assessed on a day-by-day basis and will not be retrospective over any other period.

2) Where the FUM of the Fund is below $100m, the Fund Expenses may be considerably higher.

The Aura Term Deposit Fund looks to provide liquidity to its investor base.

Provided there is Available Cash for the Manager to do so, valid redemption requests will be assessed at the close of each business day and processed on a pro-rata basis the following business day. Payments will generally be received within three Business Days.

How to Apply

Thank you for your interest in the Aura Term Deposit Fund.

Aura Group Funds have a minimum investment of A$500,000. If you meet the criteria for wholesale and sophisticated clients as defined by the Corporations Act 2001, we will consider a minimum investment of A$100,000.

Before making an application for units in the Fund, please read the Information Memorandum.