Aura Ventures Summit

Eric Chan, Keynote.

Sydney, November 2025

Eric Chan | Managing Partner & Founder, Aura Ventures

Keynote Transcript

Opening

Good evening everyone — and welcome.

Every few decades, the world quietly rewires itself.

We call it a platform shift.

In the 90s, it was the internet — moving information online.

In the 2010s, it was mobile — putting the world in our pockets.

Each shift felt messy, noisy, and overhyped at the time… until it became obvious in hindsight.

And tonight, we find ourselves standing right before the next shift.

The AI revolution is no longer a concept — it’s a force reshaping what productivity, creativity, and even human potential look like. But here’s the truth: the noise is loudest at the beginning, long before the signal becomes clear.

As early-stage investors, we sit in that noise every day.

And our job — the job of venture — is to make sense of it, to find pattern before consensus.

Part 1 — Where We Are in the Cycle

If you zoom out, every technological cycle follows a familiar rhythm.

First, valuations move. Then adoption. Then returns.

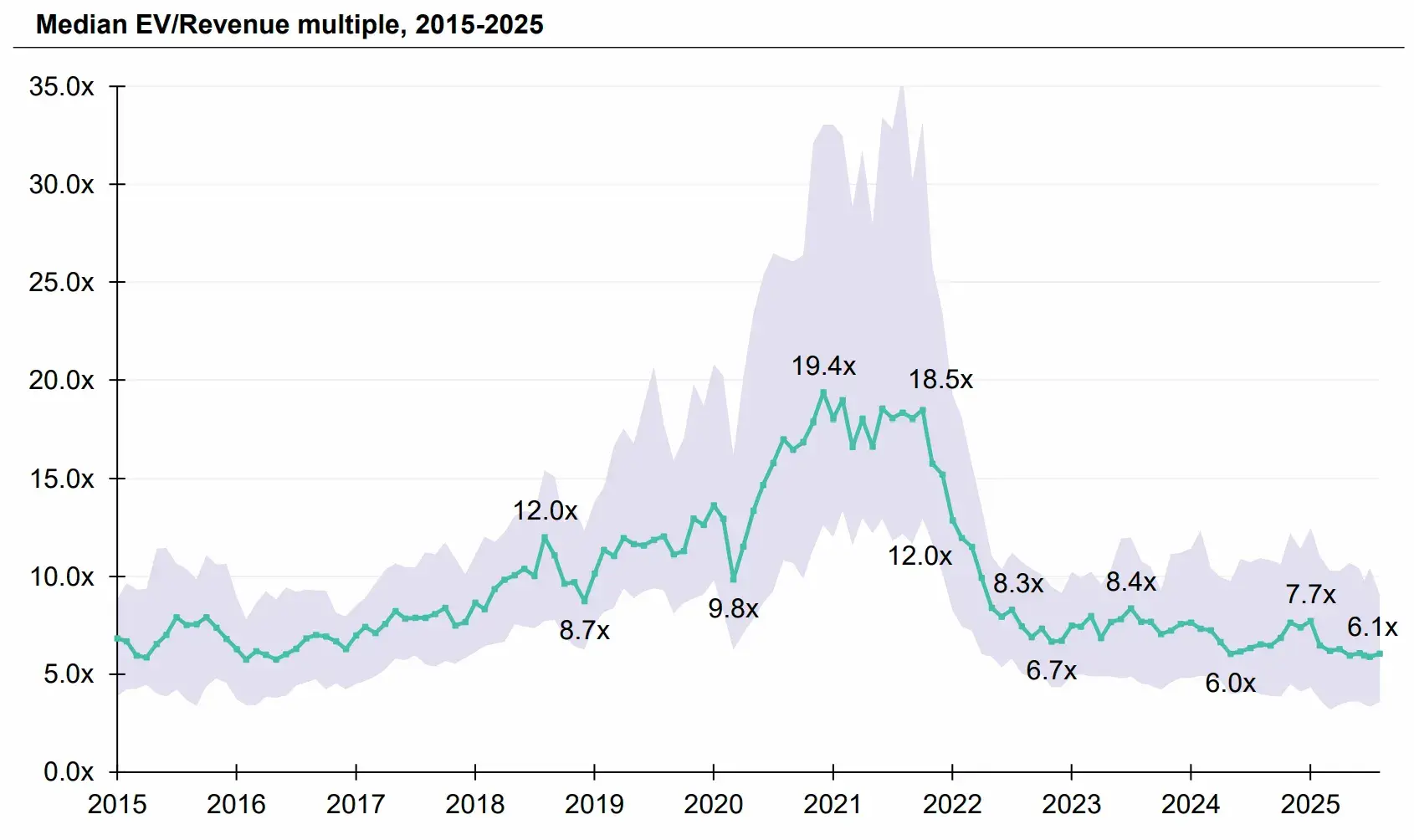

We saw it in SaaS. In the early days valuations were flat when few believed recurring revenue would justify venture multiples. Then the market realised these were unlike traditional software companies rather they were compounding machines. After the model proved itself and full adoption has occurred, valuations will reach its peak.

AI is in that early valuation phase today. Capital is being deployed, narratives built, but the full adoption and return phase are yet ahead.

While we are all seeing the headlines of companies raising at hundreds or even trillion valuations, the hype is concentrated around consumer and model labs.

Most AI-native companies are still valued as ordinary software businesses. Their economics haven’t been re-rated yet.

And that’s the opportunity.

Because history tells us that the best returns in venture aren’t captured when the story is obvious — they’re captured before it is.

Part 2 — The Opportunity

When we studied the top quartile funds over the past two decades, we identified a common pattern. They were all raised during a downturn or moments of disbelief. Vintages raised in the couple of years after a downturn outperform by around 2-3x on IRR compared to those raised in the boom. Lower entry valuations. Fewer tourists. Higher conviction.

We find ourselves once again at this juncture but the difference this time round is the Australian ecosystem is at term and we are entering the race at the starting line. Unlike with saas when the venture ecosystem was largely non existent for first half of the saas cycle.

Part 3 — Navigating the Hype

But the real question is how do you separate the signal from the noise.

When things a blurry, we lean back on first principles to find our bearings. We focus on the problem and the thesis rather than the tech or product. We remind ourselves that AI is the tool that enables the solution to the problem but not the thesis itself.

While AI is the market inflection that we seek changing the rules of the game for many industries, it is not enough on its own. It does not replace things that matter to us like the unique insight we desire in our founders.

At our VC summit 3 years ago, I said that we foresaw a new wave of software companies which will be AI enabled or AI native that will revolutionise customer experience and change customer expectation on how value is delivered. For the first half between then and now, we sat patiently learning and understanding where AI will accrue value. We skipped a wave of LLM wrappers and then made a couple high conviction bets in the second half such as Haast

This learning has allowed us to find some common traits that an enduring AI company would possess:

- They own unique data or have feedback loops that continuously improve their models within a specific domain — turning every interaction into a learning advantage.

- They are vertically focused such that they embed deeply in real workflows becoming part of the system of record rather than just another tool on top.

- They build multi-modal intelligence — combining voice, vision, and agentic reasoning. But they’re differentiated from general models through context, orchestration, and integration.

- They create trust, governance, and compliance layers that enterprises need that large foundation models can’t provide on their own.

- And finally, they develop compounding advantages over time — distribution channels, ecosystems, and network effects that make their products better and harder to displace with scale.

These are the signals we look for. The companies that don’t just ride the AI wave, but build the breakwater that defines it.

Part 4 — The Broader Lens: Past, Present & Future

Our theme tonight is Before the Shift: Past, Present and Future. This is really about how innovations moves in chapters.

In some way, it feels like the past decade of winners were defined by speed to distribution. They were those that acquired users fastest, scaled GTM machines and raised capital to fuel growth.

But the winners for this chapter will be defined by intelligence. While distribution will remain a critical element, the defining factor is likely those that learn fastest. They’ll build systems that adapt, anticipate and improve with every interaction.

Founders used to code systems that humans operated.

Now, they’ll design systems that learn from humans.

And soon, systems that teach us back.

That’s the frontier we’re investing in — not automation for its own sake, but amplification of human potential.

Closing

As investors, our role isn’t to predict what’s next — it’s to recognise when change is already underway.

We’re living through one of those moments where the world is quietly tilting forward. Acting with conviction now will shape what this next chapter becomes.

Before the shift becomes the story everyone tells — this is our moment to write the first chapter.

Thank you for being part of it.