The Blockchain 101: The Origin of Blockchain

Right now, cryptocurrency is everywhere. But what is it, and what is the underlying blockchain technology?

The year started with a conundrum. Economists, analysts, the World Bank and the International Monetary Fund all warn of a potential recession

This outlook contains information correct as at 1345hr on 31 January 2023

The year started with a conundrum. Economists, analysts, the World Bank and the International Monetary Fund all warn of a potential recession, influenced by the explosion of Covid-19 infections in China, triggering strict lockdown measures. By December, the Chinese government changed its course, implementing new policies that encouraged people to instead live with the virus. Central Banks worldwide also continued to raise interest rates to fight high inflation and the impacts of the conflict in Ukraine. This has led to higher prices in energy, food and other essentials—not to mention the slow recovery of supply chains.

According to the World Bank, global economic growth “is expected to decelerate sharply” due to the conditions outlined above. On New Year’s Day, IMF Managing Director Kristalina Georgieva also warned that 2023 will be “a tough year, tougher than the year we leave behind.”

However, a closer look at the charts of major world stock indices show that stock markets are signalling that the bottom is near. They indicate that the next move is very likely to be up, although it might take some months. Historical evidence shows stock markets tend to lead the economy by approximately 6-12 months. Stocks are indicating that there might be no recession, but perhaps a slowdown. It will be an interesting year with the Bull and the Bear tussling.

Cutting across sectors and regions in varying ways, some themes to look for in 2023 are—

Higher interest rates slowing overall growth

Rate hikes may pause by Q2

Geopolitical realignments, Ukraine/Russia, US/China/Asia Pacific

New energy options becoming more acceptable and mainstream

Social challenges from managing Covid-19

Climate exposure and mitigation

Digital finance and Fintechs losing some of their hype. Crypto winter to continue?

Blockchain might become another commercial process

Cyber security to take on a greater concern

For the week, the latest monetary policy decisions and statements from the Fed, ECB and BoE will shape markets in the coming months. December’s annual inflation has fallen to 6.5% while the 3.5% unemployment rate is at 50-year lows. In Q4 the economy grew at 2.9% YoY. The data points to a slowing, not a recessionary, economy and points to the possibility of a soft landing for the US. This keeps hope alive for US interest rates to peak at 5.25% after numerous hikes.

China’s Q4 GDP grew 2.9% YoY but after the Government’s policy change from a Covid Zero policy to a complete opening, the economy is looking up. This should also be beneficial for the global economy.

Overnight US 10-Year Treasuries gained 0.02% closing at 3.52% (29 Nov 3.69%), Australian 10- Year Govt Bonds gained 0.01% closing at 3.57% (29 Nov 3.57%) and UK 10-Year Gilts gained 0.01% to close at 3.35% (29 Nov 3.12%).

Sources: Bloomberg, MSNBC, Reuters, Business Times, 31 Jan 2023

The USD declined at the end of 2022 and beginning January 2023, but the decline is expected to slow and interest in the G10 crosses is expected to pick up as the USD consolidates. We can expect the USD and currencies to be volatile this year with the USD mainly on the defensive.

In our last 6-monthly update of the USD Index DXY in July 2022, we expected DXY to push higher in H2 to hit the technical target of 109.37, but surpassed this target to hit 114.77, a new 20-year high. The pullback from this high has been drastic and DXY is now resting around the 50% Fibonacci support at 102.00. For H1 2023 we are likely to see DXY test lower to the uptrend channel support around 100.00, and thereafter we can expect it to trade sideways.

Image Source: Bloomberg 31 January 2022

Recent Australian inflation data makes it likely for the RBA to hike by 0.25% at its 7 February MPC meeting. The market will have to re-think where the RBA will peak the Overnight Cash Rate. The AUDUSD should benefit from China’s re-opening and the recent warming of political ties plus the USD no longer has a positive interest rate differential against the AUD.

AUDUSD has penetrated the 50% Fibonacci resistance at 0.6750 and also above the resistance zone at 0.6900 – 0.7000. We are likely to see consolidation between 0.7000 – 0.7100 before the next move which on balance is likely to be to the downside, testing support at 0.6900.

Image Source: Bloomberg 31 January 2022

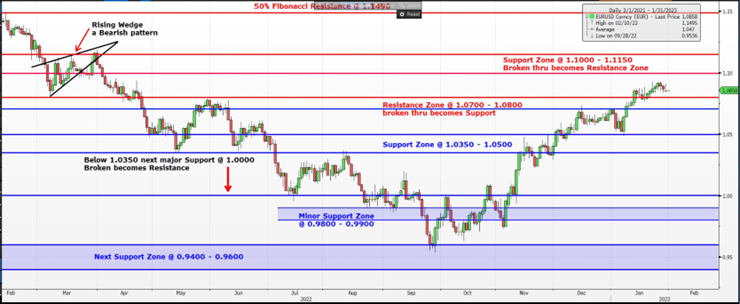

The ECB raised the interest rate by 0.5% on Thursday 2 Feb to 2.5%. This may be supportive of EURUSD as expected the Fed stepped down to a 0.25% rate increase. Over the last few weeks, EURUSD has broken above the resistance zone at 1.0700 – 1.0800. The rally appears to have ended as prices are moving sideways but still above the resistance which could become a support.

Image Source: Bloomberg 31 January 2022

In December 2022, the BoE raised its Bank Rate by 0.5% from 3.00% to 3.50%, in line with expectations. But two of its nine Monetary Policy Committee members voted for no hikes and only one for 0.75%. On Thursday 2 Feb the BoE as expected raised the BR by 0.5% to 4.0%. However, further GBP strength may not materialise as this may be the BoE’s final hike against a recessionary situation.

GBPUSD has not been able to penetrate the resistance zone at 1.2500 – 1.2650 and appears to be losing momentum. The immediate scenario is for GBPUSD to trade between 1.2000 – 1.2500.

Image Source: Bloomberg 31 January 2022

A panel of academics and business executives has urged the BoJ to make its 2% inflation target a long-term goal, to let interest rates rise in line with economic fundamentals and normalise Japan's bond market function.

However, BoJ Gov Haruhiko Kuroda emphasized price stability and reiterated that 2% inflation is achievable with wage growth and the current easy policy. Japan’s inflation outpaced forecasts to hit 4% for the first time since 1982, suggesting the underlying price trend is stronger than initially thought by economists.

USDJPY has penetrated the Fibonacci 76.4% support at 130.50 but has bounced up again to just below 130.50. USDJPY is expected to trade on either side of 130.50 as the USD consolidates

Image Source: Bloomberg 31 January 2022

Singapore’s economy held up in 2022 with full-year GDP growth at 3.8% slightly better than the government’s forecast for 3.5%. Forecasts for 2023 ranges from 0.5% to 2.5%. Official data on 25 Jan showed December Core inflation remained unchanged at 5.1% for the third consecutive month. The Monetary Authority of Singapore (MAS) is expected to tighten again at its MPC meeting in April as headline CPI remains elevated at 6.1% YoY for 2022. After tightening by the MAS last October, USDSGD has not stopped its precipitous drop. It is now hovering above 1.3100. We can expect USDSGD to trade between 1.3000 – 1.3200 for Q1, but looking forward we may see USDSGD drop to the 1.2500 – 1.3000 level later this year.

Image Source: Bloomberg 31 January 2022

AUDSGD has staged a consolidative recovery from its lows into the 0.9200 – 0.9300 resistance zone. The current rally might exhaust below 0.9400 and range trade for some time between 0.9000 – 0.9300.

Image Source: Bloomberg 31 January 2022

Gold is overvalued from a fundamental perspective, against the background of high and rising interest rates and the bottoming of stock markets. It has staged an amazing rally from above USD1,600 to above USD1,900. The explanation centres around thin market volume into the year end and beginning of the year, plus money which has pulled out from cryptos, technology and venture companies in 2022 temporarily being deployed into gold, while investors reassess.

Gold has staged a strong rally from support at USD1,600 – USD1,650 level to above 61.8% Fibonacci resistance at USD1,922. We can expect some consolidation at current levels before the next move which is likely to be down to USD1,875.

Image Source: Bloomberg 31 January 2023

Aura Global Insights and Forex Outlook is written by Tong Hoe Sng, Director of Wealth Management.

Note* In Candlesticks Chart, Green bars means the Close is higher than the Open price and Brown bars means the Close is lower than the open price.

Important information

This information is for wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia and is issued to accredited, qualified, wholesale, sophisticated and institutional investors only.

Right now, cryptocurrency is everywhere. But what is it, and what is the underlying blockchain technology?

How do we feed the 9.7 billion people of tomorrow with today's knowledge of increasing demand for food and a food production system that is near...

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone

Subscribe to News & Insights to stay up to date with all things Aura Group.