Aura Group Launches Proprietary Digital Distribution Platform Aura Marketplace

Aura Group is pleased to announce the public launch of Aura Marketplace, our private markets investment portal available in Australia and Singapore.

The political climate over the last decade has indicated a potential shift in global power.

To get a better grasp of what the future looks like, we ought to look at the past. Ray Dalio, the founder and co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, has done just that in his new book, Principles for Dealing With the Changing World Order.

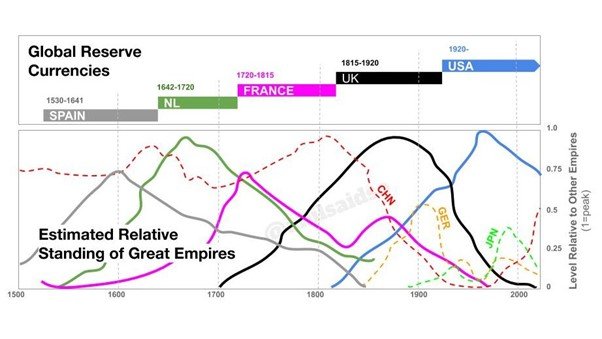

In it, he argues that it is important to study historical patterns, in particular events that may not have occurred in our lifetimes. Dalio conducted a comprehensive study of major empires and their markets over the past 500 years, including Spain, the Netherlands, France, the United Kingdom, the United States, and China. By analysing each empire’s global reserve currency status, as well as other compounding factors such as wealth inequality and political stability, he argues that the world order is shifting. Dalio flags the potential dangers ahead for the U.S. in monetary policy and the potential consequences, including armed conflict, of the growing rivalry between the U.S. and China.

What happens if we overlook new paradigm shifts like Bitcoin and blockchain? We study Dalio’s work and offer perspectives on the impact of decentralisation, the importance of nation states and the possibility of Bitcoin as a reserve currency.

“History Doesn't Repeat Itself, but It Often Rhymes” – Mark Twain

Source: Principles for Dealing With the Changing World Order – Ray Dalio

Understanding the market cycle and its impact on economies in the context of internal and external politics is essential to anticipating what’s likely to come next. Dalio believes the U.S.’s world leadership is at risk because its economy is heavily burdened by debt whilst it is experiencing domestic unrest1, and global geopolitical instability and is being challenged by rising powers.

Whilst its debt burdens are high, the U.S. has the privilege of the dollar being the world’s reserve currency, allowing it to print money to service its debts. This reduces its risk of default but increases its devaluation risk. If the U.S. lost its reserve currency status, it would be in serious financial trouble.

Currently, 55% of all central bank currency reserves are still held in U.S. dollars. Despite this, a clear shift is taking place, with the U.S. dollar gradually falling as a reserve currency, down from 69% in 20072. Recent U.S. sanctions on Russia have also made governments and central banks wary of being too reliant on the U.S. dollar. Dalio observes that throughout history reserve currencies take longer to decline than the empire itself, but when they do they decline rapidly. As Dalio notes, the Dutch guilder and the British pound both plunged in this way due to geopolitical crises/defeats happening when they had large debts.

Dalio believes China is roughly comparable in power to the United States in the most important ways, and it is on its way to becoming more powerful in many ways. China is in the middle of the rankings on the debt burden gauge because its debts are moderately high, mostly in its own currency, and mostly held by the Chinese.

China’s reserve currency status is on the rise3. Recent data shows the yuan now holding the fifth position after the U.S. dollar, the Euro, the Japanese Yen and Pound Sterling. The yuan’s share is a mere 2.5% of official foreign exchange reserves, but its share has increased dramatically since 2016. In early 2022, the yuan reached 4th in the international payments market — a remarkable improvement from 35th in 2010.

Press reports also speculate that Saudi Arabia is in accelerated talks with China to accept yuan instead of dollars for oil purchases, which if true would be a major development in the rise of the yuan. The main challenge for the yuan is that it is a controlled currency and cannot be freely moved in and out of China.

Dalio thinks that the U.S. and China are clearly in four types of war: a trade/economic war, a technology war, capital war, and geopolitical war. These low-level conflicts are not pronounced, but are intensifying, giving way to the possibility of the fifth category, military war. While the risks of such a conflict happening are currently low, it is not impossible. Dalio addresses this by tying in key concepts from Graham Allison’s book Destined for War,

As Graham Allison explained in his excellent book, “Destined for War,” in the past 500 years, when two nearly equal powers experienced irreconcilable differences, there were military wars in 12 out of 16 cases, and big military build-ups were associated with major wars in 80–90% percent of cases. I balance those historical insights with the logic of mutually assured destruction, which lowers the odds of war. On net, I would conclude that the probability of a big war in the next 10 years is 35%, give or take, which is essentially a wild guess. In any case, it’s a dangerously high risk.

Russia’s invasion of Ukraine, which occurred after the printing of Dalio’s book, further complicates this point. Since the invasion, China has faced increased diplomatic pressure due to its historical and modern alliance with Russia, which is being tested in real time.

In his book, Dalio explores traditional markets and state power with great detail, combing through the trends in each state’s circumstances. However, his study makes no mention of Bitcoin or cryptocurrency4, omitting the modern trends outside of the nation-state.

However, we believe we are in a world that is decreasingly identified by national borders and governments. The internet has effectively erased borders of communication and interaction; eroding many of the founding principles of nations in both a geopolitical and economic sense.

Whilst currencies are one of the most foundational tools of any nation, the emergence of Bitcoin is driving the growth of a new breed of netizens and corporations who believe digital currencies and blockchain technology solve many problems both economically and politically.

Digital nomads — workers who embrace a location-independent, technology-enabled lifestyle that allows them to travel and work remotely have increased significantly in number over the past few years. Recent research has found that in 2021 over 15.5 million American workers describe themselves as digital nomads, a 42% increase from 2020 and a 112% increase from 2019.

There are also new projects out there like Plan B Passport, which offers up to seven jurisdictions of choice for clients to choose from and buy a corresponding passport. Tropical havens cooperate with the project to attract affluent citizens and sell passports with all the benefits included.

Corporations continue to emerge like Binance, the world’s largest cryptocurrency exchange until recently did not have any head offices registered in any country and FTX the world’s fastest-growing exchange has chosen to be headquartered in the Bahamas. The introduction of the concept of a DAO, a Decentralised and Autonomous Organisation without a typical management or board structure will test traditional concepts of substance and control.

The architecture of Bitcoin puts it at an advantage to function as a reserve currency. Bitcoin is becoming a more frequent medium of exchange, as it has many of the sound attributes of money, being that it is valuable, portable, divisible, indestructible, homogenous, and cognizable. Despite its utility, its largest criticism is its volatility which affects its ability to be a store of value. Unlike fiat money, which is bound to be inflationary, Bitcoin was created to be scarce with its maximum supply capped at 21 million. Currency manipulation has also plagued the global currency markets with governments regularly intentionally devaluing their national currencies in relation to other currencies, thereby reducing the cost of exports to gain an advantage over competing countries.

Crypto enthusiasts are already seeing Bitcoin as their reserve currency with the increased rate of digitalization in the world and posit that Bitcoin will become the world’s next reserve currency. Its inability to be printed and devalued make it an interesting candidate. In 2021, Bitcoin became legal tender in El Salvador, suggesting that it has a chance to challenge today’s prominent reserves currencies, should nation-state Bitcoin adoption continue and as a consequence also play a role in the changing world order.

Source: https://framingbitcoin.com/101-reasons-why-bitcoin-will-become-the-next-global-reserve-currency

[1] For example, in a 2019 Pew survey 55% of Republicans and 47% of Democrats viewed the other as more immoral than other Americans, and 61% of Republicans and 54% of Democrats said that those of the other party don’t share their values. Another study reported that 80 % of Democrats think that the Republican Party has been taken over by racists and 82% of Republicans think that the Democratic Party has been taken over by socialists.

[2] https://www.freshplaza.com/article/9412778/russia-sanctions-might-increase-impetus-for-chinese-yuan/

[3] https://theconversation.com/russia-sanctions-new-impetus-for-chinese-yuan-to-move-up-the-reserve-currency-ladder-179602

[4] In press interviews, he shares the view that regulators will outlaw it if it becomes too successful.

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

Aura Group is pleased to announce the public launch of Aura Marketplace, our private markets investment portal available in Australia and Singapore.

Brian Ho, Associate Director at Aura Private Credit, shared insights on the burgeoning potential of Australian private credit markets during his...

Would the adoption of technology-driven SME credit underwriting processes by ADls pose a threat to Australian SME Private Credit investors? Why?

Subscribe to News & Insights to stay up to date with all things Aura Group.