Gravity and Growth in the Australian Venture Capital Market

The talk of never-ending growth can be worrying in investor land, as everyone knows — what goes up must come down.

Southeast Asia has long been touted as this decade’s land of opportunity for private equity investors looking for growth. And rightly so. The economic support of a burgeoning and young population, strengthening technology infrastructure and rising urbanisation makes for an attractive investment landscape.

The numbers speak for themselves.

PE investment activity has expanded by almost 30% in the last four years to reach an estimated US$13 billion in deal value in 2022 (following a pre-COVID peak of US$25bn in 2021). With ongoing geopolitical tensions and regulatory risks in China, investors seeking exposure to Asian private equity have found a market that has a growing commercial landscape buoyed by macroeconomic trends and more importantly is ready to receive PE investment.

What’s even more remarkable is that in such a culturally and economically diverse region as Southeast Asia, the operating and investing playbooks are notably similar to precedents in other more mature PE markets a decade ago. The rise of key business models in certain industries and sectors continues to mirror that of China, South Korea and India five to ten years ago, underpinned by the very same demand-side and supply-side changes.

The logic of the “time-lag effect” is simple: such advanced markets have already undergone the iterative process to create stronger product-market fit in response to such market characteristics, which is then translated into successful business models. Entrepreneurs in developing markets then apply these models to their own economies that contain similar market characteristics and therefore market gaps; on a broader scale, this generally results in the development and maturing of a local market that matches that of the advanced markets with a general time lag of 5 to 15 years.

Compare Indonesia to China.Both are highly populous Asian countries with a vast geography and a significant rural-urban divide. Mobile penetration rates are in the low 100s (read: very high) and proper banking infrastructure is only concentrated in tier 1 and tier 2 cities. Both countries have rising literacy rates, with Indonesia at 96.1% (China’s 2014 levels), and growing median disposable income.1

It is little coincidence, then, that Indonesia’s developments in e-commerce and FinTech reflect that of China’s a decade ago, with Indonesian e-commerce players such as GoTo and Blibli comparable to Chinese counterparts Didi and JD, and Indonesia’s Akulaku and Ovo to China’s Zhima Credit and Alipay.

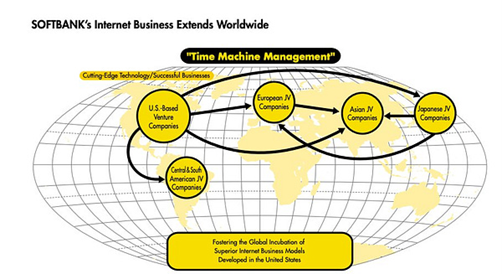

Investors have long used the time-lag effect to formulate effective strategies. The founder of Softbank Group, Masayoshi Son, was known to have religiously followed the “time-machine” strategy in his business, and even made his investment in Alibaba in 2000 on the basis that China’s nascency in technology and the internet was simply the beginning of the same development trajectory he witnessed in the United States.

(Source: Allocators Asia)

Vision Plus Capital, a Chinese investment firm coincidentally established by a co-founder of Alibaba, has also based its investment thesis on a “new time machine” theory, where the development of China’s PC internet has learned from the path of the United States in the past 10 years, and the development path of China’s mobile internet in the next decade will be a reference for other emerging markets. Closer to home, East Ventures and Asia Partners are both Singapore-based investors, which have constructed their approach to deployment on the perceived time-lag in Southeast Asia to China and the US.

So, the question isn’t so much if there is a time-lag effect in Southeast Asia vis-à-vis mature market benchmarks, but rather where that effect is strongest and most applicable for the requisite growth profile characteristic of private equity asset class.

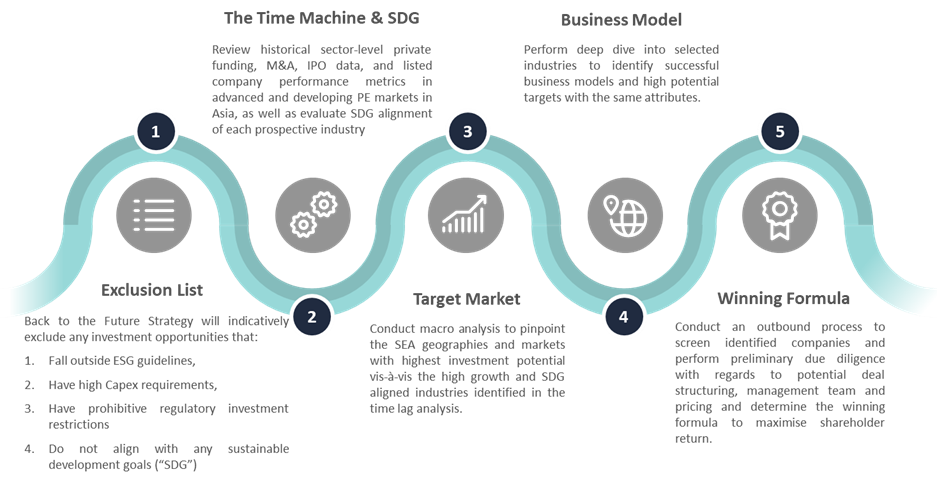

(Source: Allocators Asia)

At Aura Private Equity, rather than investing opportunistically, we believe the data from historical market activity can be put to work in making stronger investment decisions, with the leverage from the time-lag especially relevant in an early PE market like Southeast Asia.

Our in-house models are periodically refreshed to identify relevant sectors that exhibit a time-lag with key Asian markets, based on private and public market transaction volume as an indicator of market investability. We then fine tune the investible universe by triangulating macroeconomic factors to determine optimal geographies and filtering out non PE-ready businesses (e.g. unprofitable, sub-scale, or unsustainable long-term unit economics) to identify successful business models and high potential targets. This forms the foundation of a data-driven and high-conviction Time Machine strategy where we aim to harness the learnings and observations from such time lags as a compass in what and where to best invest.

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

The talk of never-ending growth can be worrying in investor land, as everyone knows — what goes up must come down.

Self-Managed Super Fund (SMSF) portfolios lack the diversification and risk management strategies available to institutional investors. The Aura...

Ainsley Lee's approach to investment is characterised by a laser focus on risk management and capital preservation.

Subscribe to News & Insights to stay up to date with all things Aura Group.