Business conditions and confidence remain relatively soft by historical standards, reflecting persistent global macroeconomic uncertainty. The NAB Monthly Business Survey for April, conducted three weeks after the Liberation Day tariff announcements, showed tempered responses across both indicators. Meanwhile, stronger-than-expected employment data from the ABS has sparked renewed debate around the RBA’s policy stance ahead of next week’s rate decision, adding to the cautious sentiment in financial markets.

The NAB Monthly Business Survey for April 2025 indicates a modest weakening in Australian business conditions, primarily due to declining profitability and reduced investment, amidst ongoing global trade uncertainties. The business conditions index decreased by two points to +2, falling below the long-term average. This decline was mainly driven by a drop in profitability, attributed to rising input costs. In contrast, trading conditions and employment remained relatively stable.

Business confidence slightly improved by one point to -1, yet it remains in negative territory and below its historical average. This persistent pessimism reflects the cautious stance of firms amid global trade tensions, particularly following the U.S. tariff announcements in early April.

Forward-looking indicators showed notable declines. Capital expenditure intentions dropped to their lowest level since June 2024, as firms delayed investment plans due to economic uncertainty. Additionally, capacity utilisation fell to 81.4%, returning to its long-run average for the first time since mid-2021.

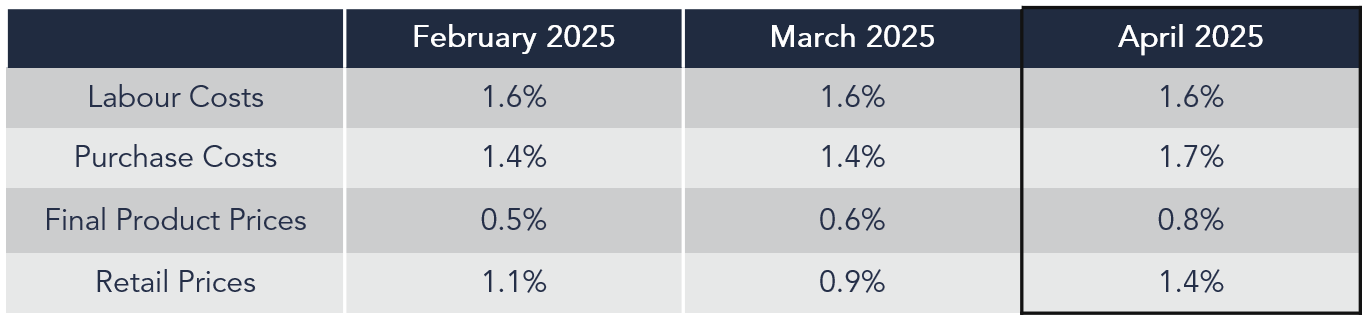

Cost pressures intensified, with an uptick in purchase cost growth and higher final product and retail price growth. While labour cost growth remained steady, the overall increase in input costs continued to squeeze profit margins.

The substantial increase of 89,000 employed individuals in April indicates a robust labour market. This growth was predominantly driven by female employment, which accounted for 65,000 of the new jobs. Despite the surge in employment, the unemployment rate remained steady at 4.1%, as the labour force participation rate also increased.

While inflation has eased and is now within the RBA’s 2–3% target band, labour market strength and rising real wages present a risk of persistent underlying inflation, particularly in services. The RBA will likely interpret the April data as confirmation that the economy is not yet cooling to the degree that would warrant immediate easing. That said, some of the labour market momentum may be temporary (e.g., election-related hiring), and forward indicators, such as rising underemployment and declining hours worked, suggest a gradual softening may be ahead.

Markets continue to price in a 25-basis point rate cut at next Tuesday’s RBA board meeting, although recent employment data has strengthened the case for maintaining a restrictive monetary stance.

Disclaimer: This is provided for information and general news purposes only and does not constitute any offer or any such invitation of any sort or in any jurisdiction. You should not construe any such information or any material as legal, tax, investment, financial, or other advice. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). However, where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564).

This information is distributed in Singapore by Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services License. View our Privacy Policy here.