Private Credit Weekly Insights, 31 October 2025

September Quarter CPI

Australian Economy Weekly Update — Week Ending 31 October 2025

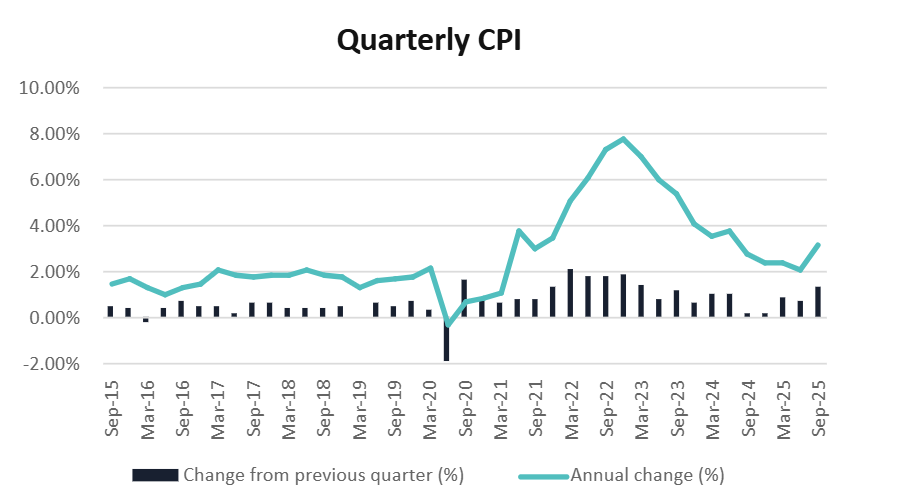

The latest Consumer Price Index (CPI) data show that inflation re-accelerated in the September 2025 quarter, underscoring the persistence of price pressures across key sectors and complicating the near-term outlook for monetary policy.Headline CPI rose 1.3% in the quarter and 3.2% over the year to September, up from 2.1% in the June quarter. Trimmed-mean inflation also edged higher to 3.0%, reversing the downward trend seen earlier in the year and signalling that underlying inflation remains above the RBA’s 2–3% target band.

Price rises were broad-based. Housing costs increased around 2.5%, driven by higher rents and construction costs, while electricity prices surged 9% in the quarter amid wholesale energy volatility and the expiry of some temporary rebates.

This result represents a setback in the RBA’s disinflation path. Policymakers are likely to interpret the data as evidence that inflationary persistence, particularly in services and utilities, remains entrenched. With both headline and core inflation now moving away from the target midpoint, expectations for near-term interest rate cuts have been effectively pushed back into mid-to-late 2026. Markets have already priced out earlier easing, reflecting a “higher-for-longer” policy stance.

The latest CPI print underscores a resurgence in inflation volatility, with the Aura Private Credit investment team preparing for an extended period of tighter monetary policy. This environment highlights the importance of disciplined underwriting and a defensive portfolio posture, focused on preservation of investor capital.

Source: Australian Bureau of Statistics, Consumer Price Index, October 2025