The Blockchain 101: The Layers of Blockchain — L3 & L4

A smart contract is just like a normal contract between two parties. There are terms and conditions that each party must follow.

Small to medium enterprises (SMEs) have been underserviced in the lending market for some time, further exacerbated by the COVID-19 global pandemic.

Small to medium enterprises (SMEs) have been underserviced in the lending market for some time, further exacerbated by the COVID-19 global pandemic. The onset of the COVID-19 Global Pandemic in March 2020 brought shock and great uncertainty for individuals and business owners. The global interruption presented governments and businesses with a new unchartered challenge that had to be addressed immediately and with no precedent to follow. As a result, many countries enforced lockdowns and harsh restrictions, imposing significant challenges to businesses large and small. Many SMEs unable to operate throughout lockdowns received government support after proving significant losses and disruption to the business’s normal operation; however, with the government support now gone, who is left to support them?

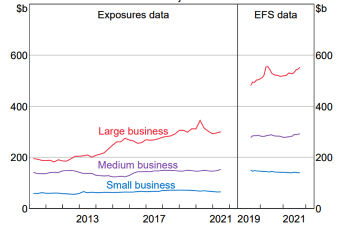

Small and medium-size businesses play a critical role in the Australian economy, employing more than five million individuals. According to the RBA, SMEs account for one-third of private output and are a key source of innovation and competition. One key issue SMEs have always faced is access to finance. The lending opportunities provided to SMEs have been relatively flat over the past few years, with the big banks focused on servicing larger and well-established businesses.

Lending to Business*

Break Adjusted

Exposures data captures credit exposures on the balance sheets of banks allowed by APRA to use an internal ratings-based approach for credit risk management; EFS data is based on reporting of banks and finance companies that have $2 billion or more of business credit.

Sources: APRA; RBA

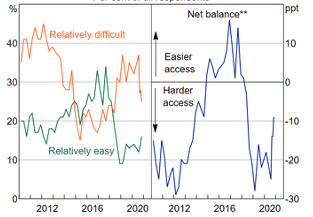

Small Business Perception of Access to Finance*

Percent of all respondents

* Survey has asked about perceptions of changes in access to finance relative to a previous period since July 2019; before that the survey asked for point-in-time assessments

**Net balance is the difference between the percentage of firms indicating access is relatively easy and the percentage of firms indicating access is relatively difficult

Sources: RBA; Sensis

SMEs received government support and stimulus throughout the peak of the pandemic as access to finance from lenders grew tighter. That said, the COVID-19 pandemic adversely affected many operating within the SME sector, forcing many businesses to shut up shop, let go of staff and discontinue trading for months on end with the harsh lockdowns and restrictions imposed. Further to this, SMEs have been largely affected by the pandemic given they are more likely to be in industries that have been harder hit by the lockdowns such as those operating within the hospitality, arts and recreation, travel, and tourism sectors.

The avenues of support and stimulus provided to SMEs throughout the pandemic varied across different providers. The government’s policy response with JobKeeper in Australia, and various other cash subsidies, provided some cash flow relief and enabled businesses to reduce their labour costs and retain staff throughout the pandemic. Some lenders offered SMEs relief by switching to interest-only payments and allowed COVID-19 payment extensions. The introduction of the SME Guarantee Scheme allowed lenders to participate and offer cheaper loans to SMEs. Some landlords also offered to reduce rental prices for a short term or allowed for rental payment extensions. Whilst these lifelines were provided, for some SMEs, these were not enough to withstand the prolonged period of lockdowns enforced over the two years. Most of these support solutions are no longer offered and ceased once lockdowns were lifted.

This brings us back to the lending gap in the SME market. The big banks have a more cautious and reserved approach when it comes to lending to smaller businesses and prefer to focus on large businesses that lend significant amounts. The big banks view lending requests from SMEs as inefficient, as the loan sizes are relatively small, however, the credit analysis required on the business is the same for a larger loan exposure. Therefore, there is a lower return on hours spent for the bank, unless technology is used to create efficiency in the assessment process. Outside of the banks, there are not many overseas lenders entering the market due to the size and scale of the SME lending space in Australia. It is a costly investment to enter a new market, and for this space, it may not be worthwhile for some lenders given the sheer scale. This leaves us with the fintech lenders that we support at Aura Group. Fintech lenders fill this gap for SMEs. These lenders rely on technology to provide the finance and fund business requirements such as cash flow management, inventory, invoice financing and CAPEX.

Fintech lenders aim to bridge the gap left by the banks and traditional lenders by tapping into an under-serviced SME market. The RBA noted that data suggests non-traditional sources of finance accounted for less than two percent of overall SME lending in 2018 . The technological aspect behind these lenders plays an important role in completing credit and underwriting assessments for borrowers, as the lack of historical data for many SMEs makes the credit assessment process more cumbersome for lenders to undergo. Having said this, technology is beginning to pave the way, allowing lenders to have access to a greater range of datasets to assist in the development of their credit assessment and underwriting processes. With greater data comes greater knowledge and understanding. We are seeing Fintech lenders invest in data collection solutions, which provide richer data for them to complete their assessments. This is particularly useful for those smaller borrowers that have little information to provide and allows the lenders to respond to their client's needs in a much shorter timeframe.

Further improvements to this space are being made, as lenders share their data which creates a richer database upon which credit assessment processes can be developed. Further investment into technology and data collection for SME lending will be crucial to the building of this market. With a larger database of information to tap into, lenders and borrowers alike will have a greater basis upon which to conduct their credit assessment and underwriting processes and source the best borrowing opportunities that suit their business’s needs. Perhaps in the future, a more unified approach to data collection and credit ratings will be developed specifically for the SME industry, creating a more streamlined and widely adopted lending space in Australia.

This post was contributed by a representative of Aura Group. The principal purpose of this post is to provide information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary, before making any decisions.

Notes:

1 RBA Small Business Finance in the Pandemic, https://www.rba.gov.au/speeches/2021/sp-ag-2021-03-17.html

2 RBA Small Business Finance in the Pandemic, https://www.rba.gov.au/speeches/2021/sp-ag-2021-03-17.html

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

A smart contract is just like a normal contract between two parties. There are terms and conditions that each party must follow.

Self-Managed Super Fund (SMSF) portfolios lack the diversification and risk management strategies available to institutional investors. The Aura...

Small and Medium Enterprises (SMEs) have long been neglected by the banking sector in Australia.

Subscribe to News & Insights to stay up to date with all things Aura Group.