Aura Group Appoints Private Credit Specialist Brian Ho as Associate Director

Aura Group enhances its private credit team with the appointment of Brian Ho as Associate Director. First introduced to asset management in 2005,...

December marked a positive Christmas trading period, with typical discretionary spending channels such as travel and social activities limited.

December marked a positive Christmas trading period for retailers, with typical discretionary spending channels such as travel and a large number of social activities limited.

In Australia, brick-and-mortar retail benefited from a 6% year-on-year increase in sales on Boxing Day1. In the U.S., retail sales grew 3% year on year, driven by online sales, as shoppers were reluctant to visit stores in person, a stark difference from the 3.5% decrease during the Global Financial Crisis2.

Despite positive retail performance in December 2020, 2021 seemed to begin with a similar flavour to 2020. Donald Trump finally conceded the presidential election, pledging an "orderly transition"—though not before ordering the NYSE to ban, reinstate and then ban again 31 Chinese companies that were believed to be tied to the People's Liberation Army (possibly creating some tactical opportunities we are investigating). The UK went into its third and most stringent lockdown after a new variant of COVID-19 was discovered (with a suspected increase in transmissibility), and Brisbane went into a 3-day lockdown after a quarantine worker tested positive for this UK variant.

The continuation of vaccine roll-outs across the world and the expectations for the recovery of the economy has buoyed financial markets and investor confidence.

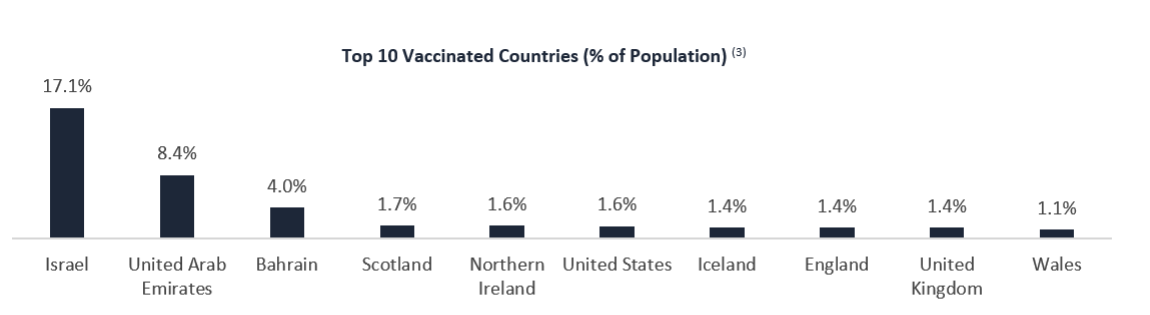

However, the actual percentage of those vaccinated are still low, limited by (1) vaccine approval processes, (2) vaccine skepticism, and (3) vaccine production capacity and delivery:

In the U.S., only the Pfizer-BioNTech and Moderna COVID-19 vaccines have been approved by the FDA, and in Australia, the Pfizer-BioNTech, AstraZeneca and Johnson & Johnson COVID-19 vaccines are currently undergoing the TGA approval process. Nevertheless, Australia has announced a vaccine roll-out plan expected to begin midto-late February4.

Approximately 30% of medical workers surveyed in the U.S. and Germany were unwilling to be vaccinated5. It appears that this scepticism is largely driven by individuals not wanting to be "guinea pigs" for the vaccine, concerns over accelerated approvals and the associated risks with any new vaccine, reluctance to be vaccinated with the novel mRNA vaccine, a belief that the vaccine is ineffective, and a surprisingly large number of conspiracy theories.

The ability to produce and distribute vaccines is perhaps the most crucial aspect in returning to a "new normal". The estimated production volume for 2021 is c.6bn doses (equating to 3bn vaccinations)6. With only c.30m vaccinations administered to date and a global population of c.7.6bn, it will take a minimum of 12 months for c.40%of the global population to be vaccinated.

Whilst economic recovery appears to be on the horizon, we remain cautious of being overly optimistic, particularly considering the increasing number of COVID-19 cases, current low vaccination rates and the potential for a mutation that could render the vaccines ineffective.

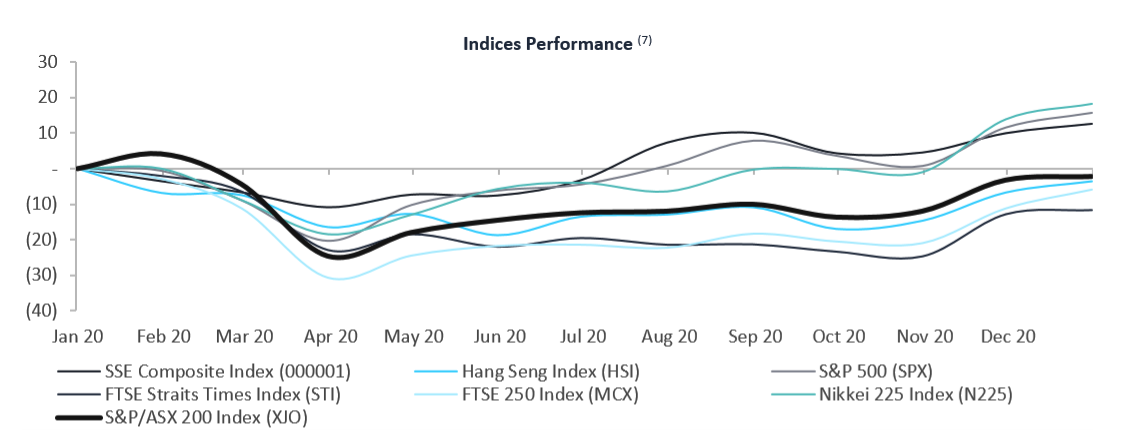

December featured mostly neutral to positive movements in indices across the globe, with increases in the US, Asia and Australia largely driven by value stocks, particularly those in the financial and energy sectors. Since the Global Financial Crisis, growth stocks have outperformed value stocks in the equity markets, however, a rotation occurred on the back of successful vaccine announcements.

The consistent performance of listed technology companies since March 2020 and the current expectation for a continued low-interest rate environment has resulted in value stocks appearing relatively cheaper. Whilst many investors are concerned over possibly tougher regulation of the technology sector or have made suggestions of a technology bubble driven by the "fear of missing out" or FOMO, we see opportunity in investing in potentially mispriced assets with positive underlying secular trends, such as eCommerce, that drive fundamental value.

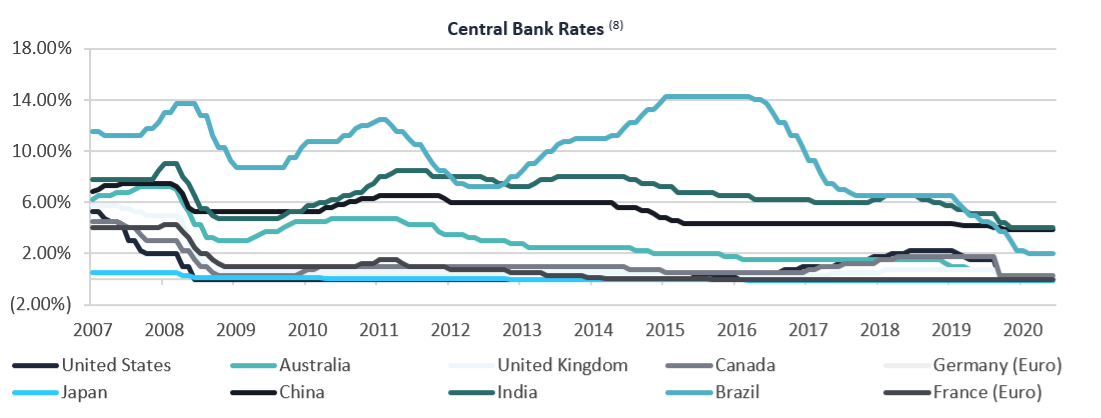

Expansionary monetary and fiscal policy have been heavily utilised by Governments aiming to firstly, maintain economic stability, and secondly, to induce a faster economic recovery following the completion of vaccination programs. Since the Global Financial Crisis, Central Banks have on average reduced interest rates by c.5%, with most countries at all-time lows8.

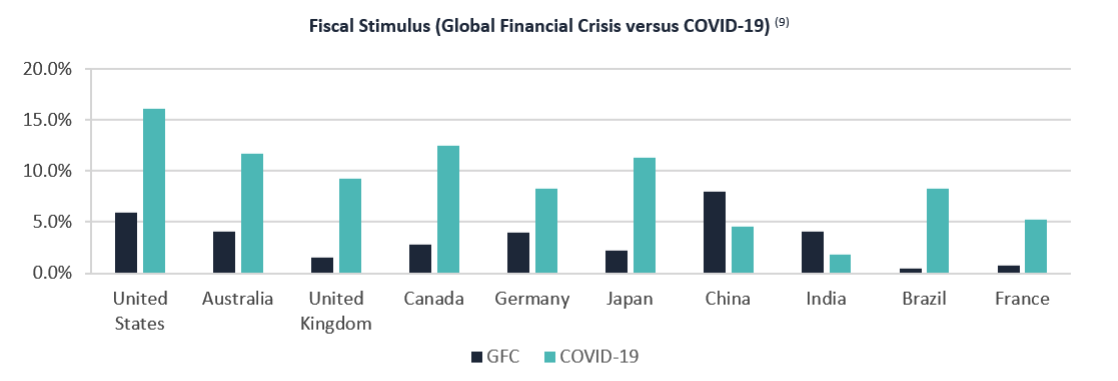

Additionally, fiscal stimulus during COVID-19 (as a percentage of GDP) has totalled, on average, c.4x the fiscal stimulus during the Global Financial Crisis(9).

These measures taken by Governments appear to be relatively successful – Q3-2020 GDP growth for the G20 rebounded by 8.1%10 but remained 2.4% below the end of 2019. We believe it is prudent to remain cautious about:

the extent to which monetary and fiscal policy can be utilised i.e. a scenario in which Central Banks are unable to reduce rates further or there is a sudden withdrawal of fiscal support, and therefore, the negative outcomes associated with these limits e.g. a deleveraging scenario;

the impact of fiscal and monetary policy on market efficiency i.e. the injection of liquidity into the market may cause the over-pricing of some assets, compounded by the search for yield and confidence that fiscal stimulus will continue;

U.S. dollar debasement and money printing globally; and

the long-term impact of this stimulus i.e. the outcomes associated with the ability (or inability) to increase interest rates from current levels or reduce public leverage.

Whilst current market conditions suggest that a smooth and fast vaccine-led economic recovery may be underway, we must be aware and cautious of risks that exist over the short and long term. As the impact of, and reaction to (by businesses and investors), COVID-19 and Government policy responses are not equal across any sector, let alone any individual company, we continue to look for, and invest in, companies and investment structures that feature strong cash flow profiles, appear to have better than average risk-adjusted returns and where possible asymmetric returns.

This analysis was written by Alyse Chow. To learn more about private equity and special situations, view our private equity page.

Notes: (1) 'Aussies spend close to $3bn on Boxing Day sales', 27 December 2020, 9 News. (2) 'U.S. Holiday Retail Sales Rose 3%, Driven by Online Shoppers', 26 December 2020, Bloomberg. (3) 'COVID-19 Data', 5 January 2021, Github. (4) 'COVID-19 Vaccine National Rollout Strategy', 7 January 2021, Australian Government - Department of Health. (5) 'Vaccine scepticism among medics sparks alarm', 8 January 2021, Australian Financial Review. (6) 'Governments need to intervene to ramp up vaccine production', 6 January 2021, Financial Times. Production volumes take into account vaccine providers Pfizer-BioNTech, Modern, AstraZeneca, and Johnson & Johnson. (7) 31 December 2020, Capital 10. (8) Central Banks. (9) ‘How much money is the G20 spending?’, 5 January 2021, Atlantic Council. (10) 5 January 2021, OECD.

This information is for wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) a Registered Fund Management Company (RFMC) in Singapore and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia and is issued to accredited, qualified, wholesale, sophisticated and institutional investors only.

Aura Group enhances its private credit team with the appointment of Brian Ho as Associate Director. First introduced to asset management in 2005,...

The retail logistics sector has undergone a major transformation, driven by AI-driven fulfilment, real-time data, and automation.

Agentic AI is redefining SaaS. Startups like Haast are leading with AI-native tools, transforming how enterprise software is built, used, and scaled.

Subscribe to News & Insights to stay up to date with all things Aura Group.