The Blockchain 101: The Layers of Blockchain — L2

An L2 network is like a GPS added to our car. It’s not made by our car manufacturer, but it was designed to improve the experience of driving the...

Carbon credits have been in the spotlight as the world seeks to decarbonise through offsets and promoting low-carbon technology to reduce greenhouse gases.

At the COP26, countries reaffirmed the goal of limiting the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit it to 1.5°C, as outlined in the Paris Agreement. From 1850 to the end of 2021, the world has used up 86% of the global carbon budget1 that is required to salvage a 50% likelihood of maintaining temperature rises to 1.5 degrees. In light of this global push towards sustainability, carbon credits in the context of Emissions Trading Schemes (ETS) have been in the spotlight in the past few years as the world seeks to decarbonise through offsets and promoting low-carbon technology to reduce greenhouse gases.

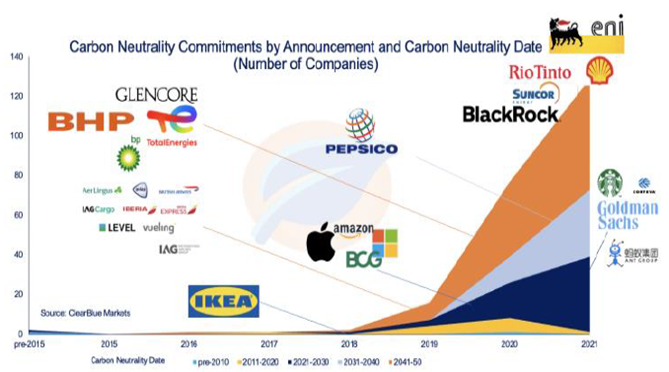

Source: Clearblue Markets2

It is no surprise that a growing number of large companies such as J.P Morgan, Disney and Blackrock are subscribing to this trend of carbon offsets. The likes of Microsoft and Amazon have pledged to go carbon neutral by 2030 and 2040 respectively. Even giants in the mining sector have joined, with BHP Group recently establishing a pipeline of decarbonisation projects3 to reduce carbon emissions by at least 30% by 2030.

In short, an ETS allows us to reduce emissions at the lowest cost by introducing a cost to carbon.

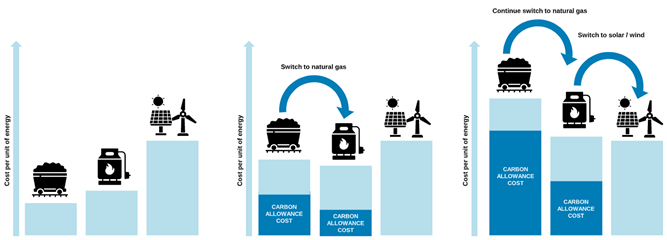

Source: Kraneshares Carbon Suite Presentation

As illustrated in the figure above, incorporating a price on carbon will increase the cost of using fossil fuels and encourage emitters to shift to alternative sources of energy such as natural gas, solar or wind. The ultimate goal is to accelerate the adoption of low-carbon technologies as the price of carbon increases and the cost of newer methods decreases.

An ETS enables the trading of carbon credits. Through this, emitters who find it costly to reduce their emissions may buy emission allowances from other emitters that can abate at lower costs.

There are two main types of systems in which carbon credits may be traded in mandatory markets: baseline-and-credit schemes and cap-and-trade schemes. However, how these schemes are implemented is determined by the governing authorities of each ETS.

In a baseline-and-credit scheme, baseline emissions are prescribed to each emitter, typically established by an independent auditor or based on historical emissions levels. These entities are incentivised to reduce their emissions below the baseline and sell excess credits to other buyers, or else purchase additional credits if they exceed their baselines.

Cap-and-trade schemes are the most common ETS and are more directly targeted towards reducing emissions than baseline-and-credit schemes. An upper limit on emissions is established, and a certain level of carbon credits that permit a unit of emissions (typically one tonne of CO2) are allocated by the regulatory body to certain emitters either for free (known as ‘grandfathering’) or through an auction. The aggregate limit of emissions under the ETS is then periodically decreased to achieve emissions reductions, thereby increasing the demand for carbon credits.

Carbon credits are credited by the governing authority to projects which reduce emissions through methods such as carbon capture and storage, reforestation and conservation, development of renewable energy or projects which improve energy efficiency. In mandatory ETSs, projects must result in emissions reductions that are verifiably additional so that projects that do not actually reduce or abate emissions are not given credits. For example, the “preservation” of land would fail the additionality test if the land was not going to be cleared without the project anyway. The number of projects that are credited forms the supply of carbon credits within the ETS.

Europe has implemented the largest mandatory ETS in the world, a cap-and-trade scheme covering 2b tonnes of CO2 and a futures market value of US$45b. The current scheme covers about 41% of Europe’s total greenhouse gas emissions and has reduced emissions from power generation and energy-intensive industries by 43% over the past 16 years4. Currently, the system is transitioning from Phase 3 to Phase 4. If the pollution levels exceed allowances, regulated entities must pay €100 per tonne of CO2 emitted for which no allowance has been purchased for, in addition to buying the equivalent number of allowances (hence the current price + €100 sets the theoretical maximum price). From 2021 onwards, the reduction on total emissions cap per year has been increased from 1.74% to 2.20%, driving the demand for carbon credits5.

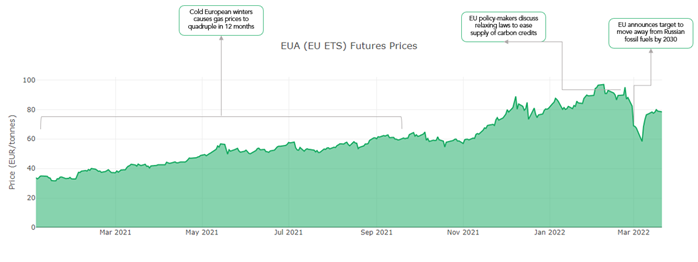

Source: Ember Climate6

EU carbon permits peaked at €97.50 in February 2022, rising more than 2,000% in the last five years. European policymakers’ actions in introducing legislation to cut emissions faster by 2030 and reducing the allocation of “grand-fathered” credits have played a big part in raising demand. A large part of carbon prices is also driven by rising energy prices in Europe (with gas prices rising more than 600% in 20217, which makes it more worthwhile for emitters to switch to alternative sources of energy.

From the recent energy crisis which has been exacerbated by the Russia-Ukraine conflict, it is clear to see that political actions will be a constant source of volatility in the carbon market. In mid-February, EU policymakers were introducing reforms to make it easier to release more permits to contain rising energy and carbon prices. When the Russia-Ukraine conflict began, carbon prices further fell to €60 as investors sold out on fears of over-valuation and future volatility. When the EU announced a plan to make Europe independent from Russian fossil fuels before 2030 by “dash(ing) into renewable energy at lightning speed”8 carbon prices rebounded back to the €80 mark.

After the Gillard Government’s carbon tax (which was a baseline-and-credit trading scheme rather than tax, contrary to common misconception) was repealed by the Abbott government, Australia currently operates under a hybrid regime that has a voluntary carbon offsets system using Australian Commonwealth Carbon Units (‘ACCUs’).

The Australian Government is by far the largest buyer (around 95%), purchasing ACCUs from projects through the Emissions Reductions Fund in a reverse auction held twice every year9.

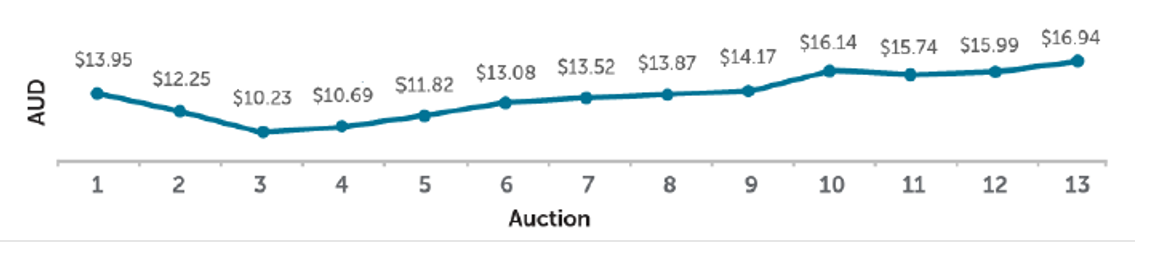

Source: Clean Energy Regulator, Emissions Reductions Fund Contract Portfolio – 13th Auction10

There have been 13 auctions, with the most recent occurring in October 2021 which had A$115.9b committed. Whilst the average price per tonne of abatement was a record high A$16.94, the Government can buy ACCUs at a much lower price than the spot market through the reverse-auction system because of their strong buying power.

Within the secondary market, the most obvious buyer group is regulated entities that exceed their baseline emission levels, which are established under what is known as the Safeguard Mechanism11. However, as these baselines have typically been unambitious in the past, virtually no entities have exceeded baselines in the past few years. We have also begun to see more voluntary entities such as corporate groups and state governments choosing to buy ACCUs to reduce their carbon footprint. Lastly, as with any established market, there are always investors looking to profit from trading activities.

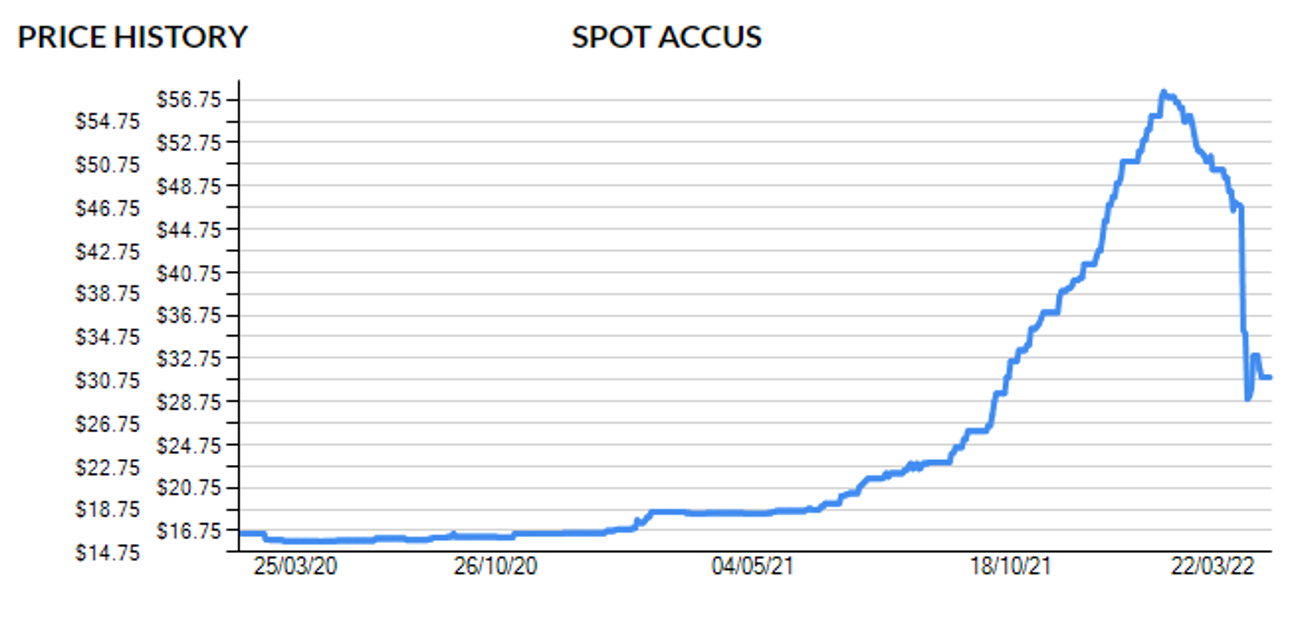

Source: https://accus.com.au/12

The spot market for ACCUs has also grown at an alarming rate, tripling in the 12 months to January 2022 and peaking at A$57. Whilst there has been increased private sector demand, this trend has primarily been driven by tight liquidity from the government’s monopoly over the market. Inevitably, the Morrison government looked to address these issues and allowed ACCU project developers to break long-term contracts from ERF auctions13 and cash in on the spot market for a break fee, resulting in the spot price falling to A$31 at the last close.

Further moves to increase trading volumes on the secondary market include establishing an Australian carbon exchange in 2023 and a regional carbon trading market between Australia and Singapore14. It will be interesting to see how ACCU prices respond to these measures, and whether the new influx of demand or increased selling power from project developers will prevail.

Exposure to carbon credits is possible through an ETF or ETN, which tracks different types via futures instruments. Some examples are as follows (a):

Notes: (a) Aura does not have a position in any of these examples.

Alternatively, we are seeing more institutional investors in the voluntary carbon credit market, which is about 2-4 times larger than mandatory markets and at lower prices than the mandatory market. These offsets are not governed under a regulatory body or treaty, like EUAs or ACCUs , but are typically how global companies are moving towards “net-zero”.

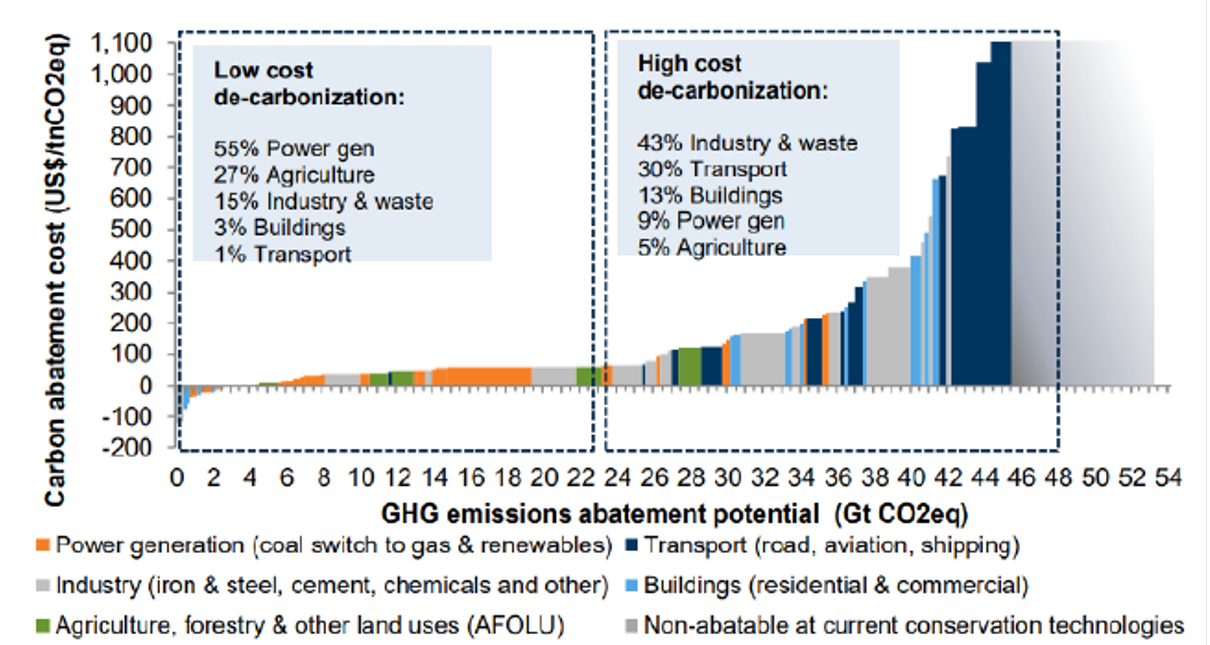

There are numerous uncertainties and risks involved in the carbon market as with any early-stage market with abnormally high growth rates. In our view, the main difficulty remains in how to value different carbon credits and disentangling their actual value from “market hype”. One of the ways to do this is to look at the marginal abatement cost curve, which depicts emissions-reducing measures based on their incremental cost and may serve as an indication of what a carbon credit price should be.

Source: Goldman Sachs Carbonomics Report

Currently, the marginal abatement cost curve is quite steep. This means that we currently have the capability to abate a low to medium level of emissions by transitioning to gas, wind and hydroelectricity. However, scaling these initiatives industry-wide remains costly, providing headroom for carbon credits to continue to rise to play a role in accelerating the tail-ends of the cost curve. By 2030 if we achieve a 50% reduction in carbon emissions, the marginal cost to abate further will exceed US$100 p/tonne15.

However, there are still uncertainties that are difficult to be resolved, such as:

Carbon credit markets are volatile, responding rapidly to political actions and policies, as seen in the case studies of Europe and Australia above;

Not all carbon credits are created equal, and voluntary markets are subject to fewer regulatory hurdles for projects to be credited. Approximately 90% of projects (which are mostly deforestation projects) fail international standards, resulting in concerns that voluntary offsets are just a form of greenwashing16;

Whilst we would prefer to be optimistic, there exists a risk that voluntary demand for carbon credits may wane as prices increase; and

Over the long term, if technological advancements are successful and the marginal abatement cost curve flattens (i.e., we are able to reduce the costs of incremental emissions reductions), then the price of each carbon credit naturally diminishes.

Our approach at Aura has been to closely monitor parallel investment themes to which companies are leveraged. Xpansive, a global marketplace for ESG-inclusive commodities such as voluntary offsets is tipped for a A$1.4b listing on the ASX in the coming months. We are also seeing significant traction in other sustainability-linked verticals such as green hydrogen fuel cells, solar and wind energy, and other low-carbon technologies that target opportunities further along the marginal abatement cost curve.

These thematics are things that we look at closely in our portfolio companies, whether it be 100% carbon neutral deliveries (Shippit), accelerating the world’s transition to a sustainable food ecosystem (Harvest B), renewable Bitcoin mining (Iris Energy) or the development of smart electric motorbikes (Ion Mobility). From an investment perspective, this space is certainly one to watch, and more importantly, we are excited to support companies that contribute to a more sustainable future.

Sources:

1. Analysis: Which countries are historically responsible for climate change

2. ClearBlue Markets EU ETS Primer

3. ASX BHP Share price climbs as miner hones in on ESG future

4. Kraneshares

5. EC Europa

6. EU Emissions trading systems

8. EU Gas Extends Rally as Crunch Risks Extending into War

9. EC Europa

10. Clean Energy Regulator, Emissions Reductions Fund Contract Portfolio – 13th Auction (22 October 2021).

11. Clean Energy Regulator Safeguard Mechanism

12. Accus

13. Chevron wins carbon market turmoil

14. Singapore and Australia plot out a regional carbon trade

15. Goldman Sachs, Carbonomics: Introducing the GS net zero carbon models and frameworks (23 June 2021)

16. NBC News

17. World’s Hottest Commodity Market for ASX listing

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

An L2 network is like a GPS added to our car. It’s not made by our car manufacturer, but it was designed to improve the experience of driving the...

With the persistent inflationary pressure not yet showing any signs of slowing, further RBA rate rises are certainly on the cards.

We are thrilled to announce the appointment of Dan Annan as our new Distribution Director. With a career spanning over two decades in the financial...

Subscribe to News & Insights to stay up to date with all things Aura Group.