From Curiosity to Conviction: Bitcoin’s Journey to Strategic Allocation

From Bitcoin’s early promise to institutional adoption, here’s how crypto evolved from fringe curiosity to financial infrastructure.

In recent times, I’ve been inundated with questions from friends and clients about digital assets, in particular Bitcoin and NFTs.

In recent times, I’ve been inundated with questions from friends and clients about digital assets, in particular Bitcoin and NFTs.

These were very similar to the questions I received in 2017, so I have dusted off an old board paper that I wrote in 2017 to share (below). The views in the paper led us to take a picks-and-shovels approach to blockchain exposure. The approach was quite fortuitous as the price of Bitcoin collapsed in late 2017, the start of the “crypto winter”.

During the crypto winter in 2018, we helped found xbullion.io, a platform that tokenises physical commodities starting with gold and shortly, silver. In early 2019, I made a personal investment in the regional digital exchange Zipmex.com. I make no comment about NFTs aside from having read a very good history of the asset class and the great potential for wash trades to inflate observed prices.

In more recent times, digital assets have become increasingly mainstream with large corporates (Microstrategy, Square, Tesla, Paypal) and more credible institutional investors are showing interest (Ray Dalio, Dan Loeb) or entering the fray (Paul Tudor Jones). What perked my ears up the most, was recently in December 2020, Singapore-based DBS — the largest bank in Southeast Asia — became one of the first traditional banks in the region to launch its own digital exchange. Within 4 months the price of bitcoin had quadrupled. We are certainly keeping a watching brief on a rapidly growing but evolving ecosystem.

A few caveats: (1) I am by no means a bitcoin/blockchain expert, I’ve read a few books (highly recommend Digital Gold by Nathanial Popper and The Truth Machine by Michael Casey and Paul Vigna) and a lot of information online. (2) This paper was not originally written for public dissemination so I may not have referenced all sources, but I am happy to update if contacted.

I have been researching and observing (1) Bitcoin (2) Blockchain & distributed ledgers and (3) other crypto-currencies for about 6 months. Whilst related it’s important to understand (1),(2) and (3) are very different.

A bitcoin is a decentralized digital currency that is issued by, and transmitted through, an open-source, digital protocol platform using cryptographic security that is known as the Bitcoin Network. The Bitcoin Network is an online, peer-to-peer user network that hosts the public transaction ledger, known as the Blockchain, and the source code that comprises the basis for the cryptography and digital protocols governing the Bitcoin Network. No single entity owns or operates the Bitcoin Network, the infrastructure of which is collectively maintained by a decentralized user base. Bitcoins can be used to pay for goods and services or can be converted to fiat currencies, such as the U.S. Dollar, at rates determined on Bitcoin Exchanges or in individual end-user-to-end-user transactions under a barter system

Bitcoins are “stored” or reflected on the digital transaction ledger known as the “Blockchain,” which is a digital file stored in a decentralized manner on the computers of each Bitcoin Network user. The Blockchain records the transaction history of all bitcoins in existence and, through the transparent reporting of transactions, allows the Bitcoin Network to verify the association of each bitcoin with the digital wallet that owns them. The Bitcoin Network and bitcoin software programs can interpret the Blockchain to determine the exact bitcoin balance, if any, of any digital wallet listed in the Blockchain as having taken part in a transaction on the Bitcoin Network.

The Blockchain is comprised of a digital file, downloaded and stored, in whole or in part, on all Bitcoin users’ software programs. The file includes all blocks that have been solved by miners and are updated to include new blocks as they are solved. As each newly solved block refers back to and “connects” with the immediately prior solved block, the addition of a new block adds to the Blockchain in a manner similar to a new link being added to a chain. Each new block records outstanding bitcoin transactions, and outstanding transactions are settled and validated through such recording, the Blockchain represents a complete, transparent and unbroken history of all transactions on the Bitcoin Network.

The process by which bitcoins are created and bitcoin transactions are verified is called mining. To begin mining, a user, or “miner,” can download and run a mining client, which, like regular Bitcoin Network software programs, turns the user’s computer into a “node” on the Bitcoin Network that validates blocks. Bitcoin transactions are recorded in new blocks that are added to the Blockchain and new bitcoins being issued to the miners. Miners, through the use of the bitcoin software program, engage in a set of prescribed complex mathematical calculations in order to add a block to the Blockchain and thereby confirm bitcoin transactions included in that block’s data.

The significance of Bitcoin is still being understood but includes the following:

Allows you to send $1,000,000,000 from/to anywhere in the world (almost) instantly, any time, with almost no (minimal) transaction fee.

Bitcoin is not controlled by a central authority and there will only be 21,000,000 coins ever created, thus the value of your Bitcoin is not dependent to a central monetary policy.

Allows any merchant to start accepting digital money without signing up for a credit card payment gateway. Also allows any merchant to start accepting money over the internet without the need for a credit/debit card.

No 3rd party fee for any transaction taking place. Since a Bitcoin transaction takes place from the sender directly to the receiver, there is a small fee for miners to validate your transaction.

The Bitcoin public ledger, also called the Blockchain, is the world's first publicly distributed ledger that is backed by a globally distributed network of computational power. One can potentially store contract, voting ballot, public identity into the Blockchain as proof of ownership.

The transaction is facilitated by complex encryption (hence the term cryptocurrency) and does not require the owner to be identified (although using players in the eco-system may).

Bitcoin has inspired many other cryptocurrencies. Those cryptocurrencies are trying to solve the problems that arise within Bitcoin and also trying to carve their own niche by addressing problems that Bitcoin is not good at solving.

The fact that it’s not controlled by any central bank or government and is finite and massively divisible makes Bitcoin very attractive as the world has traditionally used money to influence government agendas or printed money to solve economic problems. Also given that there is no single entity controlling the ledger, the risk of failure of that entity (either by fraud, hacking or insolvency) is less likely. Note this is not true of players in the Bitcoin eco-system.

Key players:

Exchanges - allow you to buy / trade bitcoin and sometimes provide Wallets

Miners - validate and record Bitcoin transactions and are rewarded with Bitcoin in return for their computing power

Wallets (both hardware and software) - assist with holding bitcoin and security

Payments providers - enable ordinary businesses to transact with bitcoin and interfaces with traditional payments providers (ie banks, visa and mastercard)

Others are peripheral applications ie lending against Bitcoin

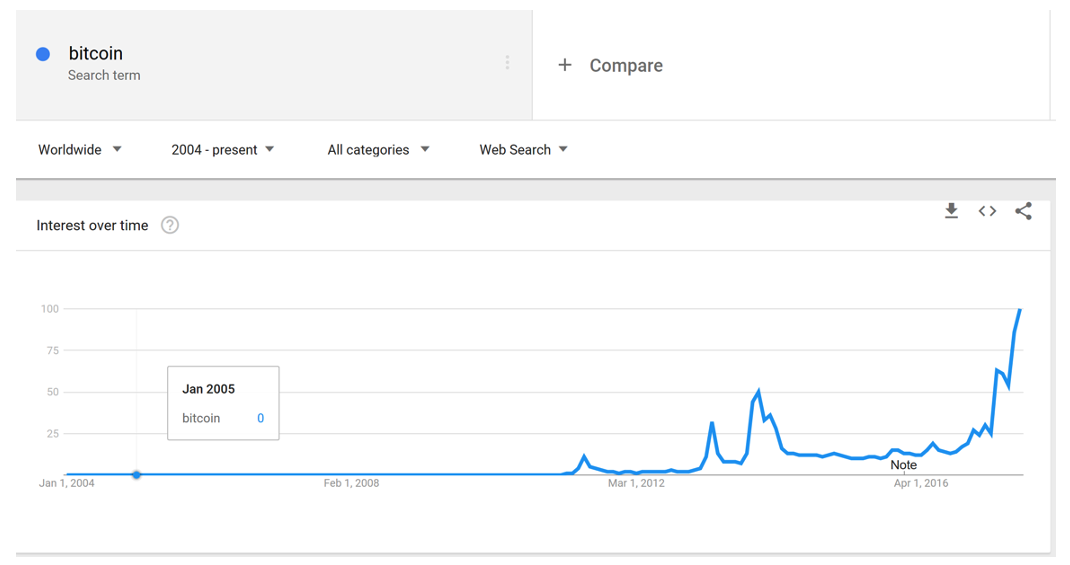

Source: Google trends 2017

More and more countries around the world have declared bitcoin legal and more and more are embracing it (and regulating it).

Credible financial institutions are now playing in the eco-system

Ordinary business acceptance of bitcoin is growing exponentially

Capital controls globally are tightening eg China

There is global unrest with global politics and distrust of fiat currencies

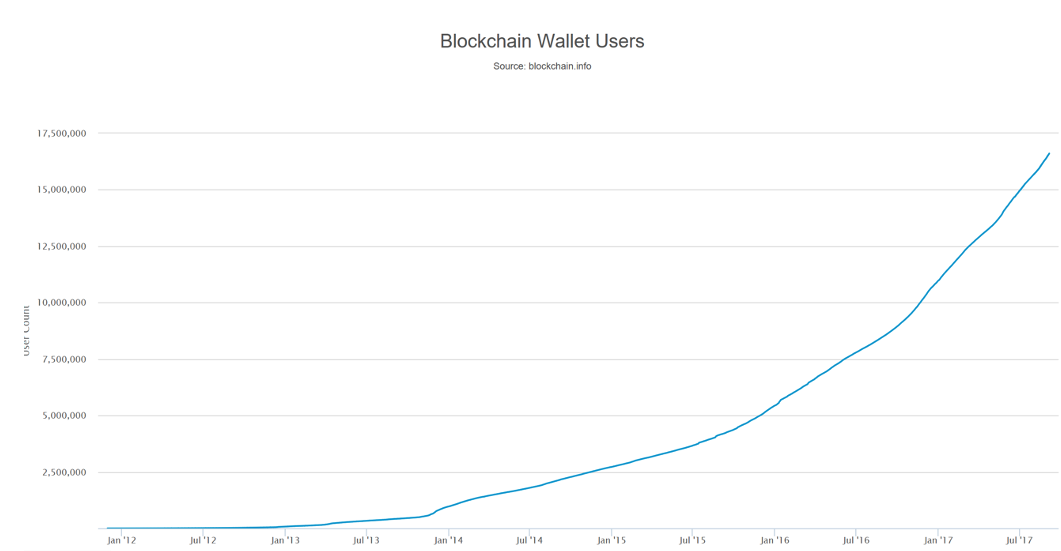

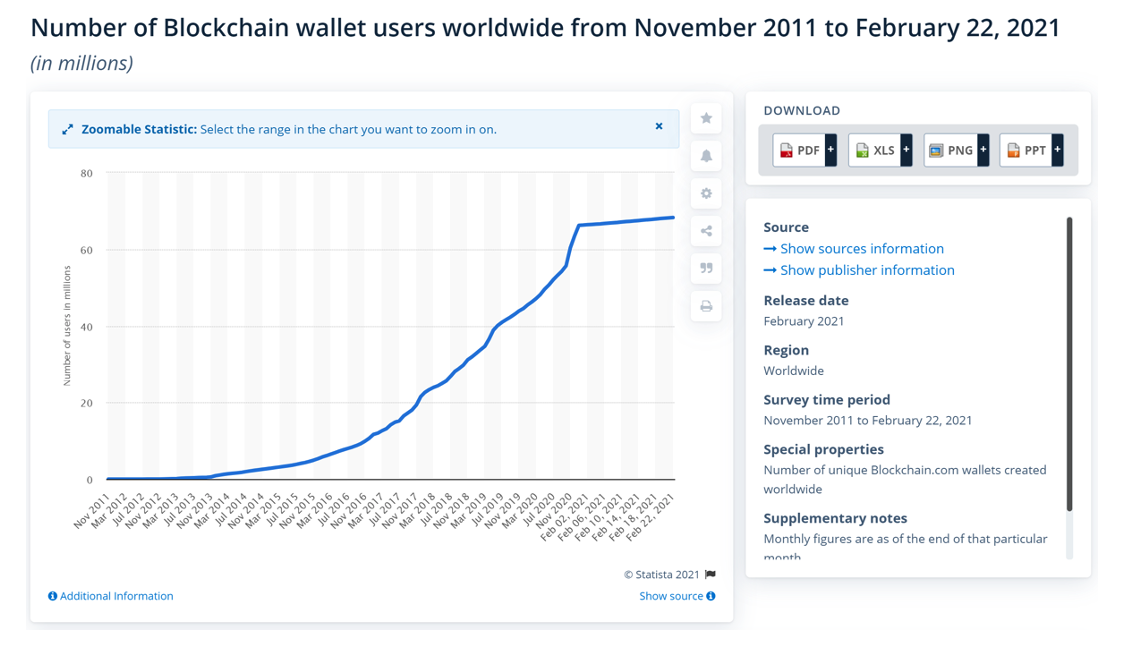

The number of wallets has exploded including rising from c10m in Jan 17 to c17m in Aug 17.

Search volume and media mentions is at all time highs

As a result, the network effect is kicking in transforming Bitcoin from what was previously (1) predominantly used for black market purposes and (2) a speculative asset into a truly widely accepted global cryptocurrency.

Understanding the above and trading in Bitcoin is extremely time-consuming and complicated. Bitcoin like any currency will become a large investment asset class that will attract attention from the masses but my view is most don’t know how to effectively get exposure.

To be clear I am not recommending speculation in Bitcoin, I don’t care whether its value USD$4500 or is $1000 or is $10m (which is the mooted number if it replaced all global wealth). Nor am I recommending anything to do with an ICO which is more around using blockchain to develop newer more obscure crypto-currencies.

What I am recommending is exploring a way to participate in the Bitcoin ecosystem in a way that is consistent with the Aura Group business model and also with our regulatory obligations. The mechanism needs to make sense irrespective of Bitcoin value

As an update to the paper, I have updated the charts in the paper below. As you can see there is some evidence that the current interest is slowing. However, the number of blockchain wallet users continues to grow to approx. 70m (up 4x since 2017) making a picks and shovels approach still very relevant.

This article was written by Aura Ventures, an early-stage venture capital firm dedicated to investing in ambitious entrepreneurs to define and dominate a new generation of commerce. To learn more, visit venture capital.

Notes:

A pick-and-shovel play is an investment strategy consisting of investing in the tools or services an industry uses to produce a product instead of the product or producer itself.

https://www.coindesk.com/bitcoin-amrita-ahuja-square-cfo-balance-sheet

https://www.cnbc.com/2021/02/08/tesla-buys-1point5-billion-in-bitcoin.html

https://www.bridgewater.com/research-and-insights/our-thoughts-on-bitcoin

https://www.coindesk.com/hedge-fund-manager-daniel-loeb-says-hes-taking-a-crypto-deep-dive

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

From Bitcoin’s early promise to institutional adoption, here’s how crypto evolved from fringe curiosity to financial infrastructure.

This month, I’m joined by John Ballinger (Founder and Chief Tree Planting Officer ) from Goodsign.

In 2008, I was made redundant from my graduate role as an Investment Analyst at Everest Babcock & Brown.

Subscribe to News & Insights to stay up to date with all things Aura Group.