Have all of the big ideas been taken? Assessing the Internet Economy in 2022

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone

In many ways, blockchains are like democracies. The system only works if there are lots of people who come together and vote

Why do people bother to vote when they aren’t required to by law? In the United States, 62% of Americans voted in their most recent election. Millions of people forfeited their time to have a say in the governance of their country.

In many ways, blockchains are like democracies. The system only works if there are lots of people who come together and vote in the best interests of the system, which is ultimately in their best interest. However, in a blockchain, there is no subjectivity of what is in the system’s best interest. It is either good or bad.

The breakthrough of blockchains, are algorithmic incentives to encourage participation in the network, so there can be decentralised consensus. In simpler terms, they create democracies that encourage lots of people to vote in the best interest of the system by offering rewards. If lots of people vote, a bad actor can’t win. Note: Remember there is no subjectivity in what qualifies a bad actor.

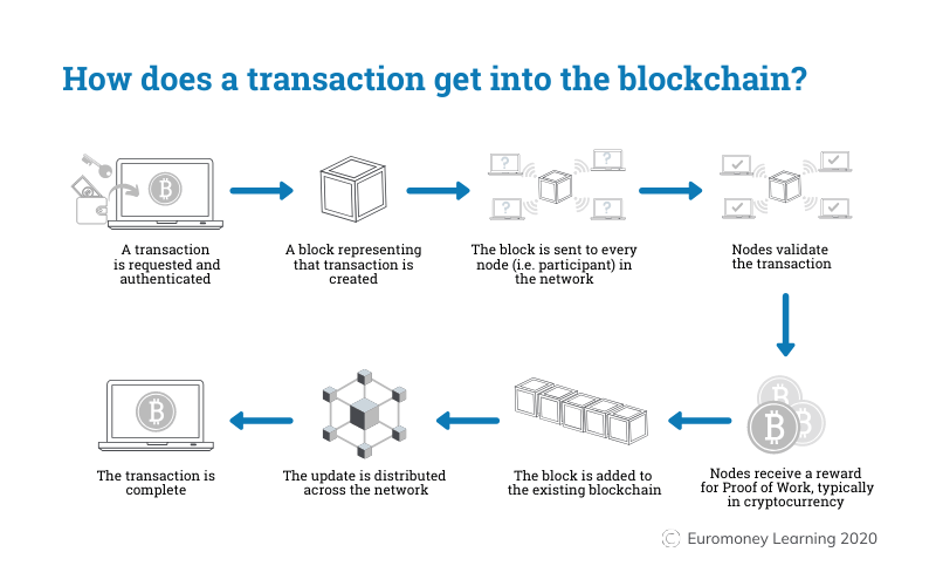

As we have touched on in the series, we know there is a ledger which anyone can add an entry with trust that it is genuine. However the question remains, why would anyone want to be a part of the system — rejecting and approving genuine transactions and storing all the data on their computer.

But why does anyone help run these systems at the beginning? Indeed, many projects with a blockchain face this dilemma of how to incentivise people to maintain the network, as they can only become decentralised if lots of people opt in.

It will make it clearer to provide some definitions. Technically speaking, consensus is a mechanism used in a blockchain system to achieve the necessary agreement on a single transaction as valid or not, across a distributed number of systems. Basically, it is the democratic vote amongst computers whether a transaction is genuine or not. Each consensus mechanism must provide some incentive for computers to participate. No one would vote in the election of another country if it didn’t affect them personally. So how do these consensus systems get people to vote?

First, let’s explore the different types of consensus mechanisms that exist:

Proof of work (PoW)

Proof of stake (PoS)

Proof of capacity (PoC)

And many more

Proof of work requires a computer to do a difficult task before it can add data to a blockchain.

It’s similar to requiring people to drive all the way to the ballot box and fill out information before they can vote. By having to put in effort, it makes attacks more difficult. Bitcoin is the most famous example of a proof of work blockchain. The model works like this:

Every computer validates each transaction and then completes a maths problem that requires lots of computing power to solve. The problem is designed to be impossible to calculate without brute-force guess work, taking an average of 10 minutes for one of the world’s Bitcoin miners to guess. The stronger the computer, the more guesses. The first computer to guess it adds the new block to the blockchain and receives Bitcoin as a reward. Using our voting analogy, it is as if by going all the way to the ballot box and casting your vote, a random person from the winning party will receive a huge payout. A lottery of sorts. The only difference is unlike a democratic election, the more compute power, the more lottery tickets you get. So, by supporting the infrastructure, you get the chance of a payout. This is how Bitcoin incentivises computers to maintain the network.

Admittedly, proof of work has flaws, it wastes a lot of energy solving pointless maths problems. So how else can a network incentivise enough people to vote for a system to be decentralised?

Proof of stake is another common consensus mechanism. Computers that approve transactions also get a chance to add to the blockchain. Instead of lottery tickets being issued based on how much computing power they have, they are issued based on how much of the cryptocurrency/token they have locked the protocol. Locked just means the money is deposited in a smart contract and cannot be removed for a set period. The more they have, the more lottery tickets they get and the higher chance they will be randomly selected to add the next block. Although they only have this chance if the majority agrees that the block they are adding should be next (consensus).

Ethereum is transitioning away from a PoW to a proof of stake (PoS) model. Currently, Tezos, Cosmos and Cardano are all PoS blockchains. All have different variations of the proof of stake model, but the rationale is the same. To harm the network, people would need to have so much money locked in the protocol that it becomes financially infeasible to do so.

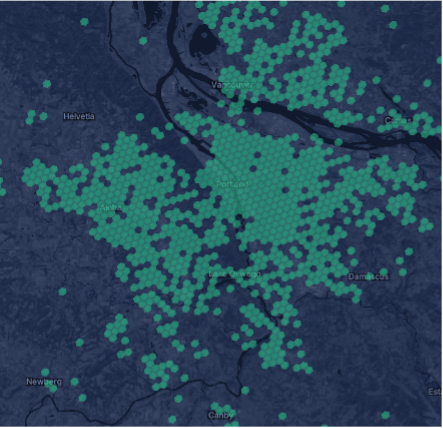

Blockchains are exciting because there are almost infinite ways to encourage consensus. Creativity is key. While most blockchains use either a PoW or PoS model, there have been a number of novel approaches. Take, for example, Proof of Coverage by the Helium Blockchain. Helium has created the world’s first peer-to-peer Wi-Fi network for IoT devices. In order for a node, in this case, a Wi-Fi modem, to validate other network activity, the actual location of the modem is checked using radio frequency.

Like a jigsaw puzzle, people receive more rewards for filling the gaps in the map. This encourages people all over the world to add to the network in places where there is no existing coverage.

While it’s more complex than that, the ramifications are rather simple. Humans can be programmed to do things by a novel consensus mechanism that rewards them for being part of a network.

This can be seen with other models such as proof of capacity, proof of activity and proof of elapsed time. All of these allow users who contribute resources to the network to have more rights & benefits from maintaining the network.

With elaborate incentive models, human behaviour can become programmable like never before. Groups of people who have never met can be mobilised to establish complex systems. It is the next evolution in human cooperation. People all around the world are setting up 5G networks together and sharing computer space with each other. Being able to design incentives is leading to an explosion of innovation in decentralised systems.

This article was written by Eric Tran, Associate at Aura Ventures, and originally appeared on Medium. You can follow Eric for more articles regarding blockchain, Web3, and funding on his profile.

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone

We are excited to welcome Mun Hoe Leung as part of the Aura Private Wealth team. Mun Hoe is the latest Private Wealth Advisor of the Aura Group...

What are the phases a founder must go through from the moment that initial idea is hatched to global behemoth? A quick search results in an array of...

Subscribe to News & Insights to stay up to date with all things Aura Group.