From Nascent to Necessary: Reflections on Seven Years in Private Credit

Seven years ago, the Aura’s Private Credit Income Strategy was born out of a vision that had been brewing in my mind for years. I had observed two...

There has been a lot of talk in markets and rhetoric from the central banks focused on whether the spike in inflation is transitory.

In the May 21 Aura Newsletter, Calvin Ng wrote an interesting piece titled, “Inflation Boogeyman”. Points raised in the article are highly relevant to investors and should be considered in light of any potential impacts on their portfolios.

Datium Insights - Moody’s Analytics Price Index Sale price - market, % change yr ago

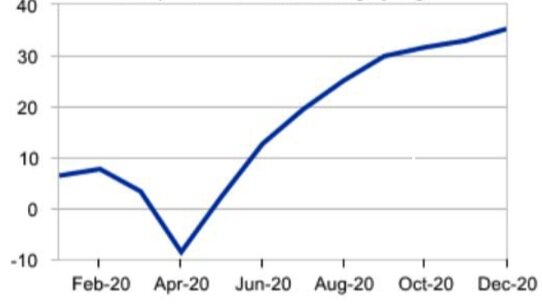

There has been a lot of talk in markets and rhetoric from the central banks focused on whether the spike in inflation is transitory. Without a doubt, supply chains have been heavily disrupted by Covid, limiting supply for consumers, and resulting in price inflation and price inelasticity with certain items. For example, in Australia, new car delivery times have been dragged out to further than 3 months. This has not only impacted the consumer market of new car purchases but car rental businesses that are constrained from growing their fleet to match the growing demand from domestic tourism. This has resulted in car rental hire price hikes. Further to this, used car prices have seen dramatic rises, increasing 35.2% in December 20 YoY. The question will be, will this change if the global economy resets with a relaxation of border restrictions? If so, then inflation is transitory.

Historically, post-recessionary periods, inflation has spiked temporarily due to pent-up demand. In 2020, the pandemic resulted in a global short-lived recession (countered by aggressive central bank actions), assuming historical trends are a reliable reference point, then inflation should soften as demand falls away. Again, if this is the case, inflation is temporary.

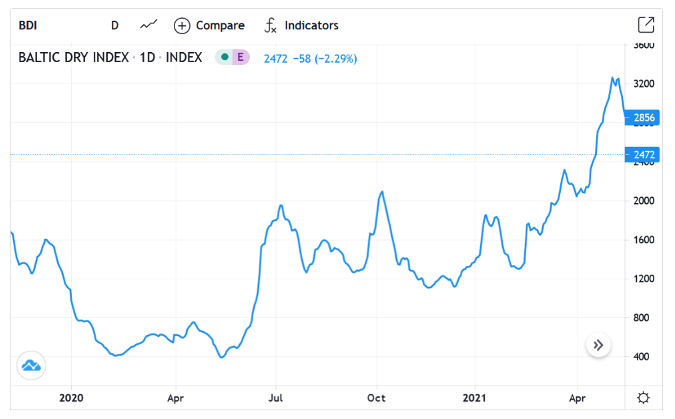

On the flip side, it can be argued that supply chain disruption was less impacted than most believe. The Baltic Dry Index; a measure of the average prices paid for the transportation of materials and used as a leading indicator of economic activity, dipped in December 2019 but began trending up in May 2020. Similarly, the JPMorgan Global PMI; a measure of the direction of economic trends in manufacturing with a measure over 50 points reflecting an expansionary phase, reflected a similar recovery. Without a doubt, the supply chain was disrupted, the question is the depth and resulting impact on supply and demand to spike inflation.

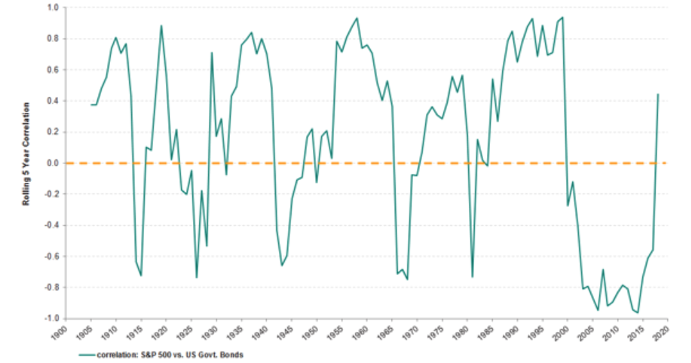

As investors though, knowing and identifying the risks is as important, and if not more important, than finding the opportunities. Typically, central banks control rising inflation with corresponding interest rate hikes. As interest rates rise, discount rates also rise with the cost of the debt component, impacting the discounted future cash flows and lowering the implied valuations of investments. As a result, equity valuations tend to fall, particularly in growth stocks where positive free cash flows may be extended out to a longer timeframe. Rising interest rates also place a risk on debt serviceability of overleveraged businesses and credit default risks. As interest rates rise, so too do yields on bonds. Bond yields and bond prices share an inverse relationship, meaning rising yields equal falling bond prices. Traditional thinking for asset allocators is that equities and bonds are uncorrelated so can hedge out some risk. The below charts show that historically, the correlation between bonds and equities moves through cycles. Recently, the correlation between the two asset classes was +0.55. This may impose a risk on traditional balanced portfolios.

*chart shows rolling 5 year correlation of annual returns netween the S&P 500 and a 10 year US govt. bond; data as at 31 Dec 2018. Source: Ardea Investment Management, Bloomberg, R. Shiller Yale Data

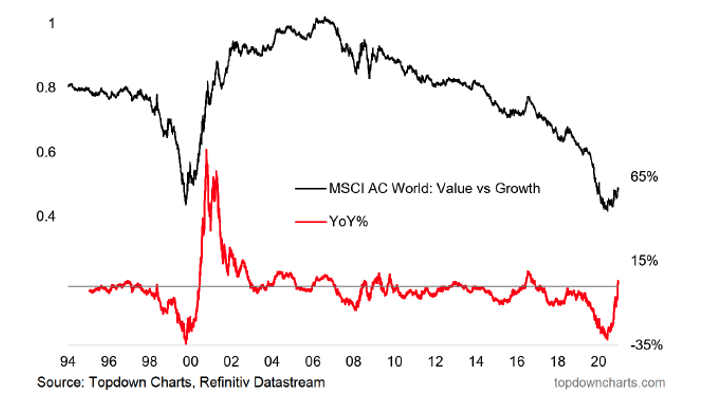

Signs of the above concerns have been evident in markets to some degree. When strong inflation data has been released, the long end of the yield curve has spiked up, with corresponding drops in equity markets (particularly in growth). As an investor, I am waiting on clearer signs of more sustained inflation growth and the reaction of central banks in response to this.

At these potential turning points, portfolio construction is vital. Identify and break down the areas of risk in your portfolio’s exposures. Potential ways to mitigate risks include investing in uncorrelated asset classes, choosing various investment styles and carefully weighting positions to manage out exposures. The recent example is value versus growth factors and the pullback because of interest rate risks.

Importantly, reference back to your investment objectives in the context of liquidity needs, risk tolerance and your investment time horizon. This will aid in the discipline around your portfolio and strip out some of the emotion.

Over the past 21 years, Ainsley has worked in both domestic and international markets and across different asset classes from equities to fixed interest to property to venture capital. Similarly, he has a depth of experience across the different asset classes, managing multi-asset multi-manager portfolios, as well as direct investments. Over the past 11 years, he has managed the endowment portfolio for Australia’s largest member-owned organisation. He is an experienced board director and has held a board position for a large corporate superannuation fund, multiple planner group committees as an independent investment committee member and as an investment committee member for several property trusts.

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

Seven years ago, the Aura’s Private Credit Income Strategy was born out of a vision that had been brewing in my mind for years. I had observed two...

For decades, the world of finance has been guided by traditional theories built on the belief in rational decision-making, perfect information, and...

The US Federal Open Market Committee slashed the Federal Reserve funds target by 50 basis points (bps) to 4.75%–5.00% in what appears to be the...

Subscribe to News & Insights to stay up to date with all things Aura Group.