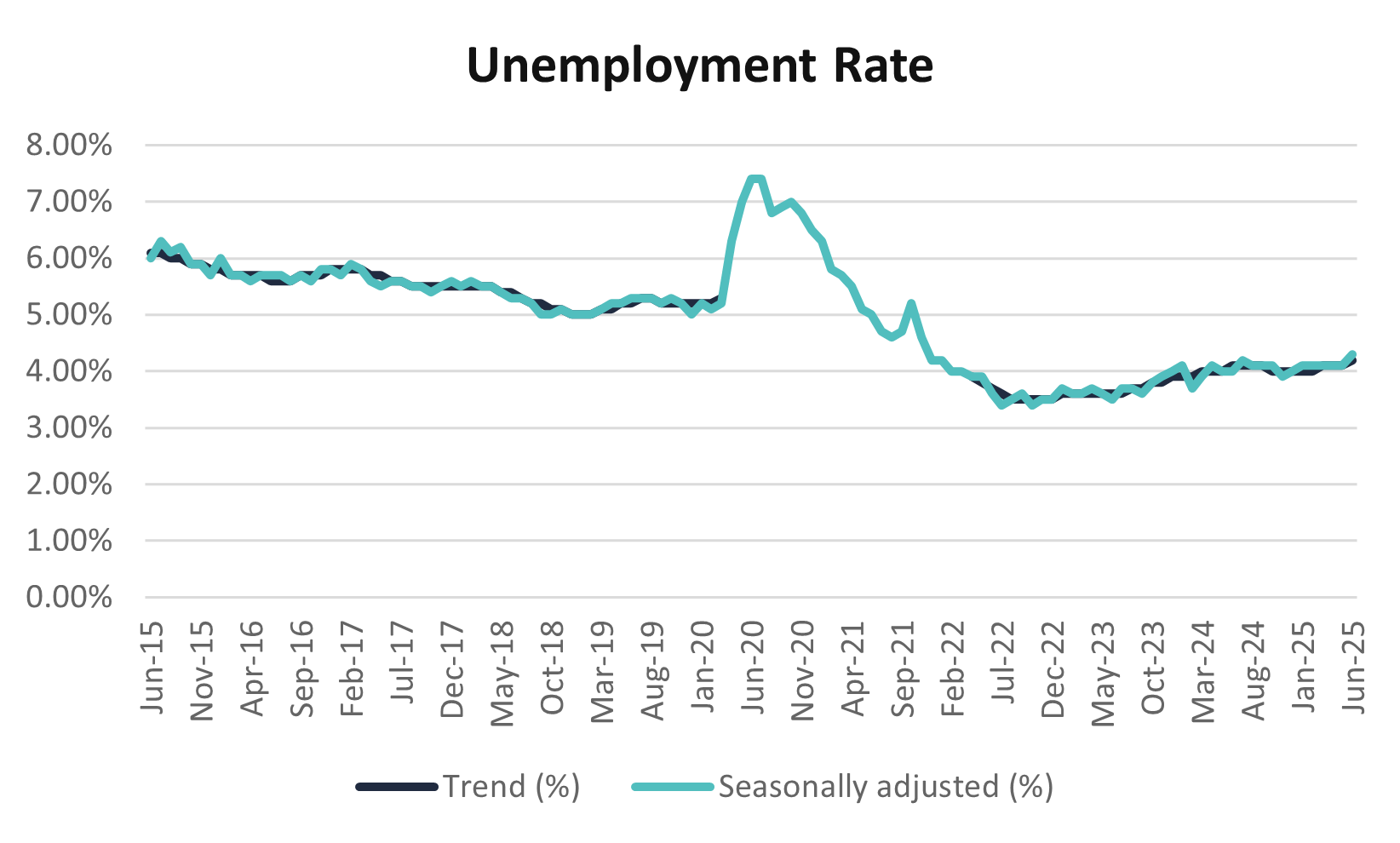

The latest ABS Labour Force data for June 2025 revealed a loss of momentum in Australia’s labour market, reinforcing recent signs of broader economic softness. The national unemployment rate rose to 4.3% (from 4.1% in May), reaching its highest level in over three years and exceeding expectations.

Employment growth was minimal, with a net gain of just 2,000 jobs, driven entirely by an increase in part-time roles, while full-time positions declined materially. Total hours worked also contracted by 0.9%, and the underemployment rate ticked higher to 6.0%, highlighting increased spare capacity in the workforce. While labour force participation nudged up to 67.1%, the data points to growing underutilisation and a trend towards more precarious forms of employment.

The data reinforces the narrative of a cooling economy and a labour market that is no longer acting as a source of resilience. Importantly, it adds weight to expectations of monetary policy easing. Markets are now pricing a 94% chance of a 25bps rate cut by the RBA at its August meeting, with bond yields and the Australian dollar falling in response to the release. A shift to a lower interest rate environment would provide renewed support to borrowing conditions and business activity, particularly for mid-market borrowers facing tighter margins and higher refinancing costs.

RBA Governor Michele Bullock has emphasised that the board places limited weight on monthly CPI prints, instead anchoring its decisions to the more stable quarterly inflation data. As such, it would likely take a significant upside surprise in the Q2 CPI figures to be released on 30 July to hold back a rate cut in August. It’s also worth noting that while unemployment has ticked higher, it remains low by historical standards. The current 4.3% rate is still below the RBA’s estimate of the non-inflationary rate of full employment of 4.5%.

Source: Australian Bureau of Statistics, Labour Force, Australia, 17 July 2025

Disclaimer: This is provided for information and general news purposes only and does not constitute any offer or any such invitation of any sort or in any jurisdiction. You should not construe any such information or any material as legal, tax, investment, financial, or other advice. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). However, where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564).

This information is distributed in Singapore by Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services License. View our Privacy Policy here