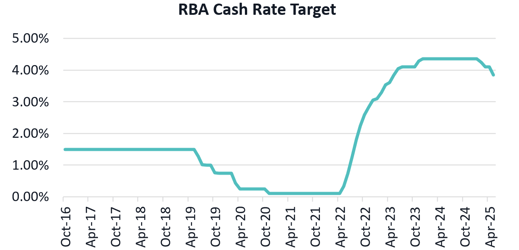

On Tuesday, the RBA reduced the cash rate target by 25 basis points to 3.85%, marking the second rate cut this year. This decision reflects the RBA's assessment that inflationary pressures have eased, with both headline and underlying inflation returning to the 2–3% target range. Specifically, headline inflation stood at 2.4% and trimmed mean inflation at 2.9% over the year to the March quarter. RBA Governor Michele Bullock struck a notably dovish tone in her post-meeting remarks, revealing that the Board actively considered a larger, 50-basis point cut, underscoring the RBA’s growing confidence in the disinflation trend and its readiness to support economic momentum.

The RBA noted that while domestic economic indicators, such as steady unemployment rates and firm employment growth, remain positive, the outlook is clouded by global uncertainties. Key concerns include escalating trade tensions, particularly the imposition of new tariffs by the U.S. on Australian goods, and geopolitical conflicts in the Middle East and Eastern Europe. These factors are expected to weigh on Australia's domestic activity and inflation in the forecast period. This resulted in the RBA lowering its forecasts across household spending, business investment and exports.

The board judged that the risks to inflation have become more balanced but emphasised that the outlook remains uncertain, heavily dependent on unpredictable developments in global trade policy. While the current monetary policy remains restrictive, the board indicated openness to further easing if international developments significantly impact the economy. Market expectations have adjusted accordingly, with forecasts suggesting the cash rate could approach 3% by mid-2026.

Bond markets are currently pricing in three additional 25 basis point rate cuts by the RBA’s February 2026 meeting, with a 75% probability that the first cut will occur as early as July. In its downside scenario analysis, the RBA has judged that an escalation in global trade tensions, particularly the trade dispute with the U.S., would likely weigh on economic growth and, in turn, lead to lower inflation. With the cash rate now at 3.85%, the central bank retains ample room to shift toward a more expansionary policy stance to support activity if needed.

The RBA's decision to lower the cash rate aims to support the Australian economy amid global uncertainties, ensuring inflation remains within the target range while sustaining employment growth. The Board’s dovish tone suggests a strong likelihood of further rate cuts in the coming months, particularly as escalating trade tensions continue to weigh on economic activity.

Source: Reserve Bank of Australia, Statement by the Monetary Policy Board: Monetary Policy Decision, 20 May 2025

Disclaimer: This is provided for information and general news purposes only and does not constitute any offer or any such invitation of any sort or in any jurisdiction. You should not construe any such information or any material as legal, tax, investment, financial, or other advice. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). However, where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564).

This information is distributed in Singapore by Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services License. View our Privacy Policy here.