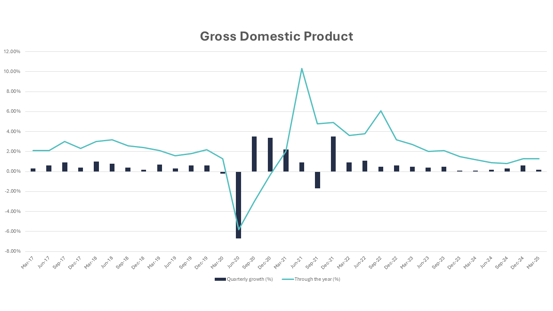

The ABS reported that Australia's Gross Domestic Product (GDP) grew by a modest 0.2% in the March 2025 quarter, a slowdown from the 0.6% growth recorded in the December 2024 quarter. On an annual basis, GDP increased by 1.3%, falling short of the RBA’s forecast of 1.6%. This subdued growth has intensified discussions about potential interest rate cuts in the coming months.

A significant concern is the continued decline in GDP per capita, which fell by 0.2% during the quarter. This marks the ninth decrease in the past eleven quarters, indicating a per capita recession despite overall economic expansion. The decline is attributed to factors such as weak business investment, stagnant productivity, and a reliance on government-funded sectors like healthcare and education.

Productivity remains a central concern in the Australian economy, having stalled at pre-pandemic levels. Business investment in machinery and equipment declined by 3.7% over the past year, limiting the potential for near-term productivity gains. This presents a structural hurdle to Treasurer Jim Chalmers’ ambitions for a transition toward a private sector-led recovery, as growth remains disproportionately reliant on government-funded activity in sectors such as health and education. The subdued investment environment reflects a broader hesitation among businesses, with many commentators citing Australia’s tax and regulatory settings as impediments to innovation and capital formation.

The weak economic indicators have led economists to anticipate further monetary easing. The RBA had already reduced the cash rate to 3.85% in May, and markets are now expecting additional cuts, potentially bringing the rate down to 2.85% by early 2026. These measures aim to stimulate private sector demand and address the sluggish economic momentum.

The March 2025 quarter data reveal an Australian economy grappling with slow growth, declining per capita income, and cautious consumer spending. These challenges promote the need for policy interventions to reinvigorate economic activity and address structural issues hindering growth.

Source: Australian Bureau of Statistics, Australian National Accounts: National Income, Expenditure and Product, 4 June 2025.

Disclaimer: This is provided for information and general news purposes only and does not constitute any offer or any such invitation of any sort or in any jurisdiction. You should not construe any such information or any material as legal, tax, investment, financial, or other advice. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). However, where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564).

This information is distributed in Singapore by Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services License. View our Privacy Policy here