Private Credit Weekly Insights, 2 May 2025

March Quarter CPI. A quick look at what is driving CPI figures in Australia

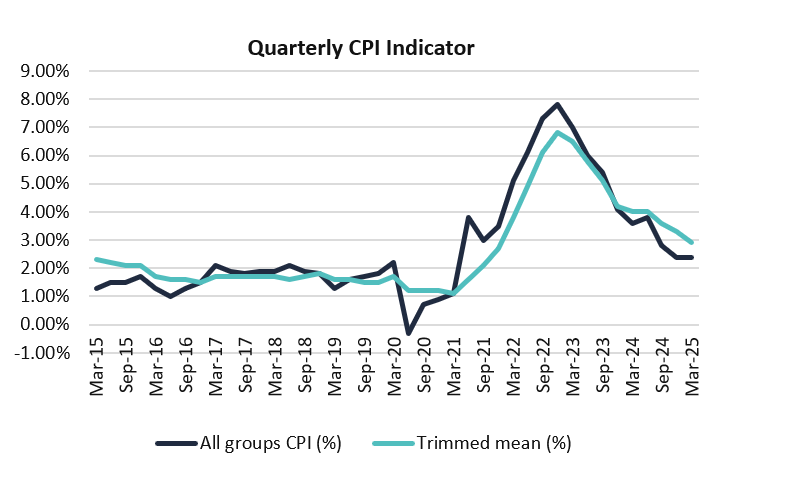

The ABS released the Consumer Price Index (CPI) data for the March 2025 quarter, indicating a continued moderation in inflation. Annual headline CPI held steady at 2.4%, aligning with the RBA’s target range of 2–3%. The RBA's preferred measure of underlying inflation, the trimmed mean, decreased to 2.9% annually, down from 3.3% in the December 2024 quarter. This marks the first time since late 2021 that core inflation has returned to the RBA's target range.

Key drivers of the March quarter CPI figures are below:

- Housing increased 1.7%: Led by a 16.3% increase in electricity prices as most households in Brisbane had rolled off the state government rebates.

- Education rose by 5.2%: Higher operating costs flowed through to higher school fees following the start of the school year.

- Food and non-alcoholic beverages increased 1.2%: Driven by shortages in a range of fruit and vegetables.

Conversely, services inflation eased to 3.7%, the lowest since June 2022, reflecting declining costs in rents and insurance. The moderation in core inflation has bolstered expectations for a potential interest rate cut by the RBA at its May meeting. Markets are pricing in a 25-basis point reduction in May and a further four rate cuts for the remainder of 2025.

In the final week of the Federal election campaign, Treasurer Jim Chalmers highlighted the drop in core inflation as evidence of effective economic management. He cited low inflation, rising real wages, and low unemployment as indicators of progress under the Labor government. Though many economists are warning Australia’s inflation issue is far from solved, particularly due to the lack of productivity improvements that have plagued the domestic economy.

While the March quarter CPI results suggest a favourable inflation outlook, looming risks from a potential global trade war and market volatility are likely to keep the RBA cautious in its decision-making. Whilst the RBA have communicated their cautious stance, markets are pricing in a cut for the next RBA meeting.

Disclaimer: This is provided for information and general news purposes only and does not constitute any offer or any such invitation of any sort or in any jurisdiction. You should not construe any such information or any material as legal, tax, investment, financial, or other advice. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). However, where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564).

This information is distributed in Singapore by Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services License. View our Privacy Policy here.