Have all of the big ideas been taken? Assessing the Internet Economy in 2022

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone

What are the phases a founder must go through from the moment that initial idea is hatched to global behemoth? A quick search results in an array of different sequences including stages like ideation, bootstrapping, explore, validate, proof-of-concept, build, launch, growth, etc.

There are a few common themes in the various cycles identified (which is a relief) but it is proof that investors, founders and advisors may have different interpretations of the different components of a company’s life (just as they have different views on what constitutes a seed round versus a series A round for example). The good news is that I have no interest in going down that rabbit hole today.

One concept, however, that is widely accepted as critical to the future success of a company and its ability to progress through the later stages of whatever company lifecycle you subscribe to is product-market fit (PMF).

American entrepreneur and venture capital investor Marc Andreessen once said, “The only thing that matters is getting to product-market fit”.

And while he is slightly biased — as he was the one who popularised the term — there is no doubting its importance in the journey of a startup.

But even today, after all of the attention PMF has received, achieving it remains an elusive goal for many founders and that is because it is highly nuanced and requires a well-orchestrated effort between the product, marketing, and strategy functions of an enterprise.

As a result, it is a common differentiator between market leaders and everyone else. Andy Rachleff (founder of Wealthfront and Benchmark Capital) who was actually the first person to introduce the notion of PMF stated,

"When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens."

So, while the above doesn’t explicitly mention product, the inference is that multiple factors are required to produce a special outcome. Rachleff underscores the importance of both the team’s capabilities and the market dynamics for achieving PMF and ultimately, business success. He emphasises that a strong team in a favourable market can yield extraordinary results, while a weak team in an unfavourable market may face significant challenges.

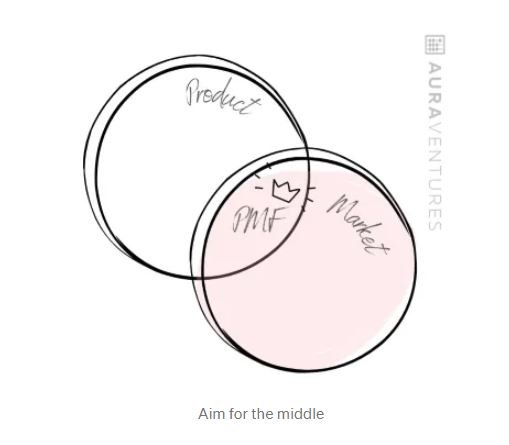

PMF is a product’s ability to satisfy a customer’s need in a particular market, and drive value for both the user and the business. As its names suggests, it lives at the intersection of ‘the product’ and ‘the market’, i.e. having a desirable product that solves a problem and a large market of customers who need the problem solved.

Great products will, first and foremost, solve a specific pain point for a customer. They may be simple initially, but even in this state they will have utility. Even at an early stage they will be made to a high quality. This is non-negotiable. Great product teams will be able to ingest feedback quickly and iterate even faster — resulting in a more feature rich and robust product over time.

Great markets obviously need to be of a certain size to warrant the time in pursuing the opportunity, but what is more important is the market’s rate of growth. Small markets can become massive very quickly. Are there strong tailwinds helping things along or is the market in structural decline? A great market also needs to permit a scalable business model such that the company can sustainably acquire customers and generate revenue.

Present tense is important in the various components of this definition. The product needs to be built, in market, and does what it says on the box. It is not an aspirational future state of the product but the one that customers currently have access to. And these customers, the ones currently using the product must love it! They need to truly value its utility today and be willing to pay for the right to access it.

Finally, the market. There must be enough of these users seeking a solution right now. It is the present state of the market, not the expected market in two or five years’ time.

Paul Graham, co-founder and partner at Y-combinator, describes product-market fit as simply making something that people want.

"Why do so many founders build things no one wants? Because they begin by trying to think of startup ideas. That modus operandi is doubly dangerous: it doesn’t merely yield few good ideas; it yields bad ideas that sound plausible enough to fool you into working on them."

And while building something that someone wants may sound like an obvious and relatively straightforward approach…it is anything but in the chambers of a young, fragile company looking to execute at the speed of a Dreamliner with the safety gear of a Cessna.

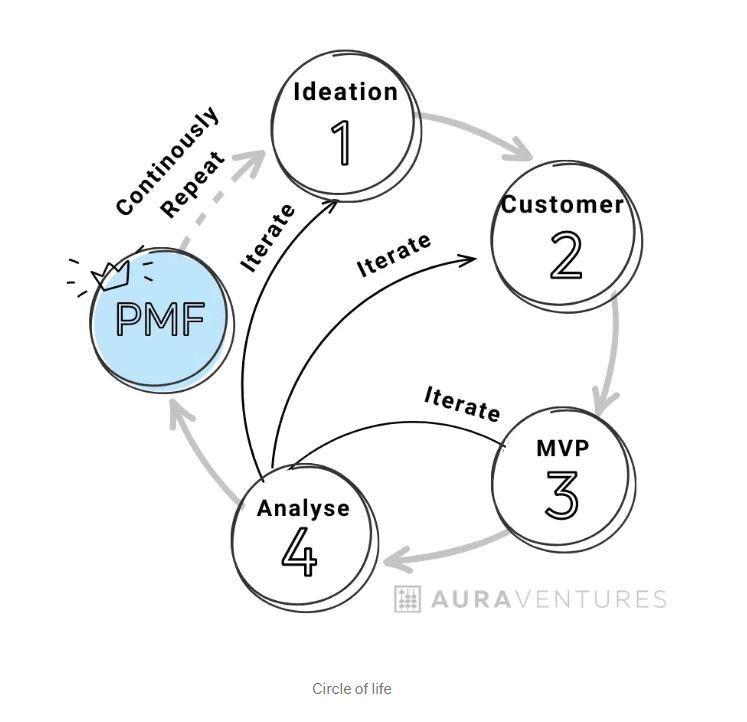

No two companies will tread the same path in achieving PMF. It is a complex and sometimes circular journey requiring a number of key phases to have been successfully manoeuvred.

In a perfect world, the path to PMF is a linear one. An idea spawned evolves into a hypothesis and business case, which quickly resonates with the target market. From there, a minimal viable product (MVP) is built as a sustainable model for distributing said product. A short time later, once the product is being fully used and enjoyed, metric testing and net promoter score (NPS) results establish that the product has achieved its objectives (albeit temporarily) and can begin to scale.

As Eric Ries, author of The Lean Startup, put it,

"When you see a startup that has found a fit with a large market, it’s exhilarating. It is Ford’s Model T flying out of the factory as fast as it could be made, Facebook sweeping college campuses practically overnight, or Lotus taking the business world by storm, selling $54 million worth of Lotus 1-2-3 in its first year of operation"

What is more common, however, is that a startup will need to grind its way through the various levels of the PMF cycle, testing and iterating at every turn (all usually done in a cash constrained environment at high velocity).

So, while each company will embark on a different road to PMF, there are of course a number of recognised frameworks that outline the stages of the PMF cycle. I have included below (that is a combination of a number of models) that I believe concisely covers the major bases.

This is the genesis of any business where the founders come up with a concept for global domination.

There should be an induced problem the market needs a solution for rather than a problem that may arise in the distant future.

Ideas are organic, companies are not. This is how nascent entrepreneurs should be approaching their areas of interest.

Use your product research, buyer persona knowledge, and value proposition to build a version of your product with only the basic functionality.

Launch your MVP with a small target audience to get their feedback on the product.

You can also use your MVP to test your value proposition and ask customers what they think about your product, how it addresses their needs, and what changes you should bring around to meet their expectations.

This includes go-to-market and customer acquisition strategy. There is no point building a whizz bang tool if you can’t sustainably get it into the hands of those who need to use it.

Using some of the techniques referenced in the next section, test to see whether there are any indicators that you are close to PMF.

As stated below, there is no silver bullet or magic number of customers that are required to achieve PMF. It will be a combination of qualitative and quantitative metrics plus a bit of gut feel.

If the metrics are still a bit off and PMF seems evanescent, continue to Step 5.

Repeat the process (all the way from Step 1 if necessary) as many times as needed (or as cashflow will allow).

Was information gathered and were assumptions made about the problem and potential customers accurate? Was the MVP actually viable? Are there product features you need to prioritise? Do the existing solutions work better or are they harder to displace than originally thought?

Hopefully you don’t have to go all the way back to the top but when in doubt, retrace your steps. Any incorrect inferences will manifest into expensive exercises.

The customer is always right so it is highly likely that additional work at Stage 2 will be required.

Keep iterating until you get there. Take the team out for a pizza.

It should be clear from the above that there are numerous teams (or multiple considerations at the very least if a small number of people are sitting across functions) implicated in the PMF cycle. This is exactly why cross-functional collaboration is vital to achieving a strong and early PMF.

A harmonious balance between product design, engineering, marketing and sales is essential.

Companies that are overly influenced by their sales team may find that they are able to successfully engage with employees but lack the necessary tools, i.e. product, to close the transaction and/or retain the customer. And conversely, companies where the product team are dominant may find themselves in possession of a product that has been over or under built in terms of what is mission critical and is not optimised for the customers’ needs. There are an infinite number of scenarios once you bake in the engineering and marketing functions, all with their own agendas and resource constraints, but unless all of these teams are collaborating with one shared objective, none of them are going to be good.

Due to the organisational orchestration required, it is no surprise that the pursuit of PMF is one that rests with the leadership of a company. This is the ultimate team sport where the importance of the captain cannot be overestimated.

Let’s run a common scenario. Your teams have been slogging away for what feels like eternity. All pulling big hours. Sales, marketing, product leads, developers and everyone in between are working together on an honourable company mission. Customers are coming in and seem to be hanging around. Cash is OK but you see the troops need a morale boost. As their leader, all you want to do is announce that all of their hard work has been worth it and confirm the news all of them had been waiting for…the business has achieved PMF and it’s time to hit the launch button.

But how do you know?

Andreesen went on to say:

"You can always feel when product/market fit isn’t happening. The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of “blah”, the sales cycle takes too long, and lots of deals never close.

And you can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it."

There is no question the above will resonate with founders on either side of the equation and while it captures the binary nature of their conundrum – founders looking for more quantifiable data points can lean on a number of metrics to help with their assessment. A few commonly employed techniques include.

Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC). Basically, how much revenue is derived from a client relative to the cost incurred in acquiring them. A high LTV:CAC indicates that the product is efficiently moving through the sales funnel into the hands of the users, suggesting it is addressing the necessary problem within its target market. A low LTV:CAC, on the other hand, could indicate a problem with the product, the marketing slant or sales approach (or all three).

Obviously the higher the ratio the better and when we are assessing for PMF, you would be looking for a number in excess of three, i.e. for each dollar spent in acquiring customers, three are returned to the company.

This is another approach that requires the calculator.

Retention rate (logo) refers to the percentage of customers or users who continue to use a product or service over a given period. You can also measure revenue-based retention rates, which are obviously valuable but may tell you more about your pricing model and ability to upsell rather than how good you are at holding on to your customers.

A high retention rate indicates that a significant portion of customers continue to use the product or service — suggesting customer satisfaction, loyalty, and recurring revenue for the business. All very important elements when searching for PMF.

You need to distinguish between new customers and returning ones and look at their behaviour at the right time. For that reason, you may need to rely on cohort analysis rather than segmentation to single out the right groups.

Retention rates will vary between industries and by product type. For example, B2B will be significantly higher than B2C, but anything above 80% is very strong in the B2B space.

The PMF survey, also known as the Sean Ellis test, is quite a subversive way of measuring how close you are to the PMF. The test is beautifully simple in that you are only required to ask a sample of your customers one question. And that is:

“How would you feel if you could no longer use [product or service]?”

Answers can take the form of:

The benchmark you are looking for is >40% of the responses being ‘very disappointed’. No prizes for guessing for why it is also called the ‘40% test’.

Due to its simplicity, it is always recommended that the test be used in conjunction with other qualitative and quantitative methods to gain a comprehensive understanding of the product’s positioning.

Similarly to the Sean Ellis test, Net Promoter Score (NPS) is a metric of the general user sentiment and as such it could be an indication of PMF.

You can use early NPS results as a baseline. As you keep iterating to solve user pain points, their satisfaction should grow, and with that the NPS.

The NPS test typically involves asking customers a single question: "On a scale of 0 to 10, how likely are you to recommend [Company/Product/Service] to a friend or colleague?" From the results, you then subtract the percentage of detractors (scores 0-6) from the percentage of promotors (scores 9-10) which will give you a score from -100 to +100.

As expected, different industries have different average scores but generally an NPS score above 50 (more happy than unhappy customers) is a good lead indicator for customer satisfaction.

So, while these tests can provide insights into customer satisfaction and advocacy, unfortunately they may not necessarily indicate PMF on their own or even when used in partnership. And even when the outputs of the above tests are positive, there is rarely a single moment when a company goes from before PMF to after PMF.

That feeling Andreessen alluded to might just be a real thing that only the most tuned-in founders will sense coming.

So, there we are. A brief introduction to the holy PMF. Hopefully it is clear at this point that achieving PMF is hard which is precisely why so many high-quality companies will never accomplish it.

Another thing to keep in mind for the trailblazing founders that have reached PMF is that it can disappear a lot faster than it appeared. Unfortunately, it is a onetime thing that requires continuous validation, feedback, and iteration based on market dynamics and customer insights. Its attainment does not mean that it is yours to keep. It also doesn’t mean that you can forget about the competition. This has never been truer in the increasingly dynamic technology markets of today.

Rather, companies need to continue to evolve as the needs of their customers do. This will require a company to infinitely run itself through the stages of the framework referenced above to ensure that it remains fully engaged with its customers and remain in the driver’s seat.

Next time you are looking at company, whether as an investor, potential employee, or just for fun, try to gaze past the obvious signals when assessing whether or not they are going to prosper and try to establish one thing — have they achieved PMF? This alone will be the biggest indicator that they are through the chasm and are well positioned to scale, capture market share, and achieve long-term success.

And what do you do if, after all that iterating and iterating some more, you still can’t find the beautiful middle of the Venn diagram? Pivot, which we cover in another article.

Read more about venture capital.

Sources:

Product-Market Fit (PMF) for SaaS: Finding, Measuring Maintaining (onix-systems.com)

Pmarchive · The only thing that matters

Product Market Fit Framework: How to Achieve and Maintain PMF (userpilot.com)

Adam Fisher on how to navigate the product-market fit journey · Bessemer Venture Partners (bvp.com)

Product-Market Fit (PMF): What It Is & How to Find It (hotjar.com)

Software is eating the world, but how many bites are left? Many are quick to say that all the obvious internet ideas are gone

As China’s era of hypergrowth slows, investors say Southeast Asia is the next China. But the idea SEA will follow China’s economic trajectory is...

When I was little, my dad would always pitch me business ideas. A personal favourite was riding a bicycle with a television attached.

Subscribe to News & Insights to stay up to date with all things Aura Group.