South East Asia — A Great (and Often Overlooked) Opportunity for Australian Founders

There is no doubt that SEA presents an enormous and potentially lucrative opportunity for Founders looking to expand outside of their home markets....

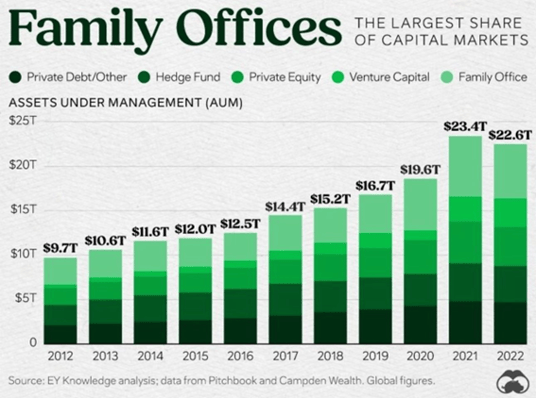

As capital markets evolve, family offices have emerged as influential entities, transforming from private wealth management vehicles into significant players in global finance.

This article explores their historical development, philanthropic impact, competitive advantage through patient capital, the need for further professionalisation, and the challenges they face, particularly in identity through succession and intergenerational wealth transfer.

According to EY, Pitchbook and Campden Wealth family offices now command the largest share of global capital markets.

Tracing back to the 19th century, family offices have evolved from managing personal wealth to influencing capital markets. Over the decades, they have metamorphosed into sophisticated entities wielding significant influence over capital markets. This shift reflects a broader change in wealth management and investment strategies.

A key driver of this evolution is the increase in ultra-high-net-worth individuals seeking direct control over their wealth. Family offices offer independence, privacy, and individually tailored investment strategies and increasingly, a focus on philanthropy.

Philanthropy in family offices goes beyond goodwill, often integrating with long-term investment strategies. Many family offices are not only donating to charitable causes but are also making strategic investments in sectors like renewable energy, education, and healthcare, which align with their philanthropic goals. These activities reflect a strategic approach to philanthropy, where giving is integrated with the family’s broader investment philosophy.

Each generation may have differing views on investment strategies, philanthropic goals, and the overall direction of the family office. This can lead to challenges in decision-making and maintaining the coherence of the family’s legacy and values.

This alignment is also part of their competitive advantage: patient capital. Unlike traditional investment firms, family offices are not constrained by short-term performance, allowing them to invest in long-term ventures and significant causes.

For example, Google co-founder Sergey Brin has quietly become the world’s largest individual donor to Parkinson’s disease research, Brin’s mother has the disease and he has the gene that makes him susceptible. He’s channeled $1.1b to the cause to date1.

Another example is the Bill and Melinda Gates Foundation, which channeled over $2b to help defeat COVID-19 in vulnerable populations, by strengthening their health systems, spurring innovation and driving equitable access to healthcare and treatments2.

However, realising the full potential of this advantage requires professionalisation. As investments grow in scale and complexity, family offices must enhance their operational strategies by having a willingness to compete and recruit top talent and by investing in and developing advanced infrastructure. These steps are crucial in maintaining their edge and ensuring sustainable growth in a complex financial landscape.

Family offices also continue to face unique challenges that traditional firms do not, notably in maintaining identity and clarity during succession planning and intergenerational wealth transfer. As family trees expand, aligning the vision and mission of the family office across generations becomes more complex. Each generation may have differing views on investment strategies, philanthropic goals, and the overall direction of the family office. This can lead to challenges in decision-making and maintaining the coherence of the family's legacy and values.

Succession planning in family offices is not just about wealth transfer; it’s about ensuring the continuity of the family’s investment philosophy and philanthropic legacy. The expansion of family branches often brings diverse perspectives and interests, which can be both a strength and a challenge. Managing these dynamics requires careful planning and open communication to align the diverse interests of family members while preserving the core values and objectives of the family office.

The evolution of family offices also brings to the forefront the need for governance structures that can manage these complexities. Establishing clear governance protocols and engaging the younger generation early in the family office’s operations can be an effective way to navigate these challenges. It's about building a bridge between generations, where the experience and wisdom of the older generation meet the fresh perspectives and innovative ideas of the younger members.

The rise of family offices signifies a shift towards more personalised, long-term, and socially conscious investment strategies in capital markets. The integration of philanthropy, patient capital, and the evolving challenges of succession and intergenerational transfer are setting new paradigms in wealth management. The future of these entities will be defined by how they adapt to these evolving dynamics, shaping their role in the global economic and philanthropic arenas.

In an era where the landscape of wealth management is undergoing profound transformations, the need for personalised, strategic, and forward-thinking financial guidance has never been more crucial. Recent trends reveal a surge in the establishment of family offices across financial hubs like Singapore, which has seen a notable increase due to the innovative use of Variable Capital Companies (VCCs).

The VCC framework offers unparalleled flexibility, tax advantages and benefits in fund management, making Singapore a preferred destination for savvy investors. Government bodies estimate over 1,100 family offices operate in Singapore, representing 59% of all family offices in Asia3.

Our family office services leverage these global trends, providing you with cutting-edge financial solutions that are tailored to your unique needs. With Aura Private Wealth, you gain access not just to traditional wealth management but to a global network of unique opportunities, tapping into emerging markets and innovative financial structures like the VCC.

Until next month,

Managing Director

Sources:

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.

There is no doubt that SEA presents an enormous and potentially lucrative opportunity for Founders looking to expand outside of their home markets....

As 2026 unfolds, amid greater global uncertainties than in previous years, means success should come to those who fuse mastery of power geopolitics,...

We are excited to announce Aura Funds Management has secured a distribution partnership with Montgomery Investment Management.

Subscribe to News & Insights to stay up to date with all things Aura Group.