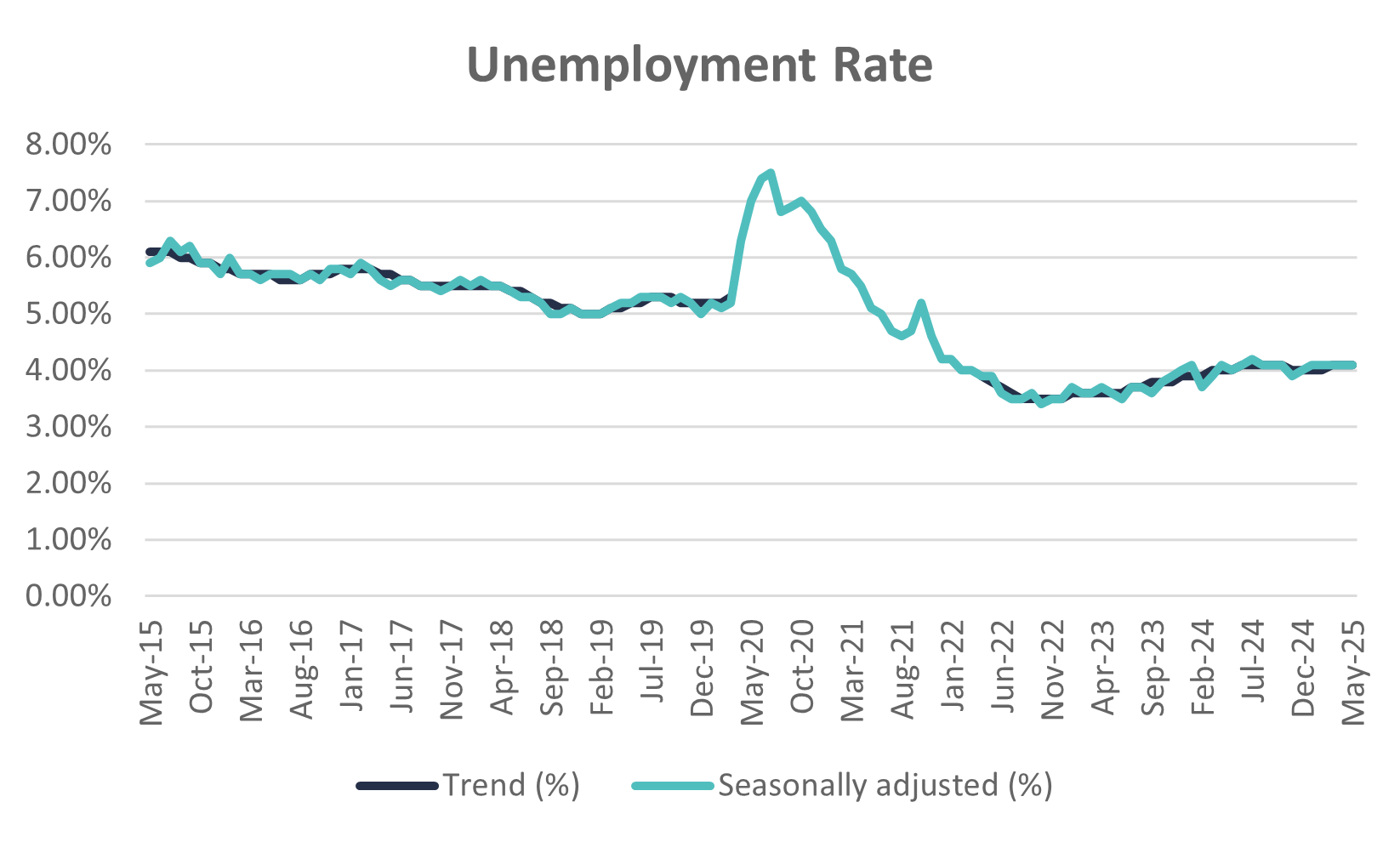

The latest ABS labour force data for May 2025 reflects a resilient but moderating labour market. The national unemployment rate held steady at 4.1% for a fifth consecutive month, while the participation rate also remained constant. Seasonally adjusted employment fell modestly by 2,500 jobs, primarily driven by a 41,100 decline in part-time positions, offset by a substantial 38,700 increase in full-time employment, a positive indicator of longer-term labour demand.

Despite the modest decline in headline jobs, the data reflect labour market resilience rather than deterioration. The loss of part-time positions follows an unusually strong April result and is broadly viewed as a normalisation rather than a sign of emerging weakness. The strength in full-time employment indicates continued business confidence in long-term hiring. Overall, the labour market structure remains healthy, with a steady unemployment rate, stable underemployment, and increasing total hours worked. The female employment-to-population ratio also reached a record high in May, reflecting ongoing improvements in labour market inclusivity.

From a policy standpoint, the continued strength of the labour market reinforces the RBA’s cautiously optimistic stance. With inflation beginning to moderate and consumer confidence still subdued, the stability in employment supports growing market expectations of a potential rate cut in July, currently priced at an 80% probability. That said, the RBA remains firmly data-dependent, weighing persistent labour market resilience against lingering inflationary pressures before adjusting policy settings. This dynamic is particularly relevant given equity markets remain near all-time highs, despite elevated geopolitical risks and an uncertain global economic backdrop. Overall, May’s data highlights a labour market that remains stable and resilient, even as headline employment slightly retreats.

Source: Australian Bureau of Statistics, Labour Force, Australia, 19 June 2025

Disclaimer: This is provided for information and general news purposes only and does not constitute any offer or any such invitation of any sort or in any jurisdiction. You should not construe any such information or any material as legal, tax, investment, financial, or other advice. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). However, where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564).

This information is distributed in Singapore by Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services License. View our Privacy Policy here