Australian Economy Weekly Update — Week Ending 3 October 2025

The Reserve Bank unanimously voted to hold the cash rate steady at 3.60% at its October meeting, maintaining a cautious stance as the economy navigates a complex mix of domestic recovery and global uncertainty.

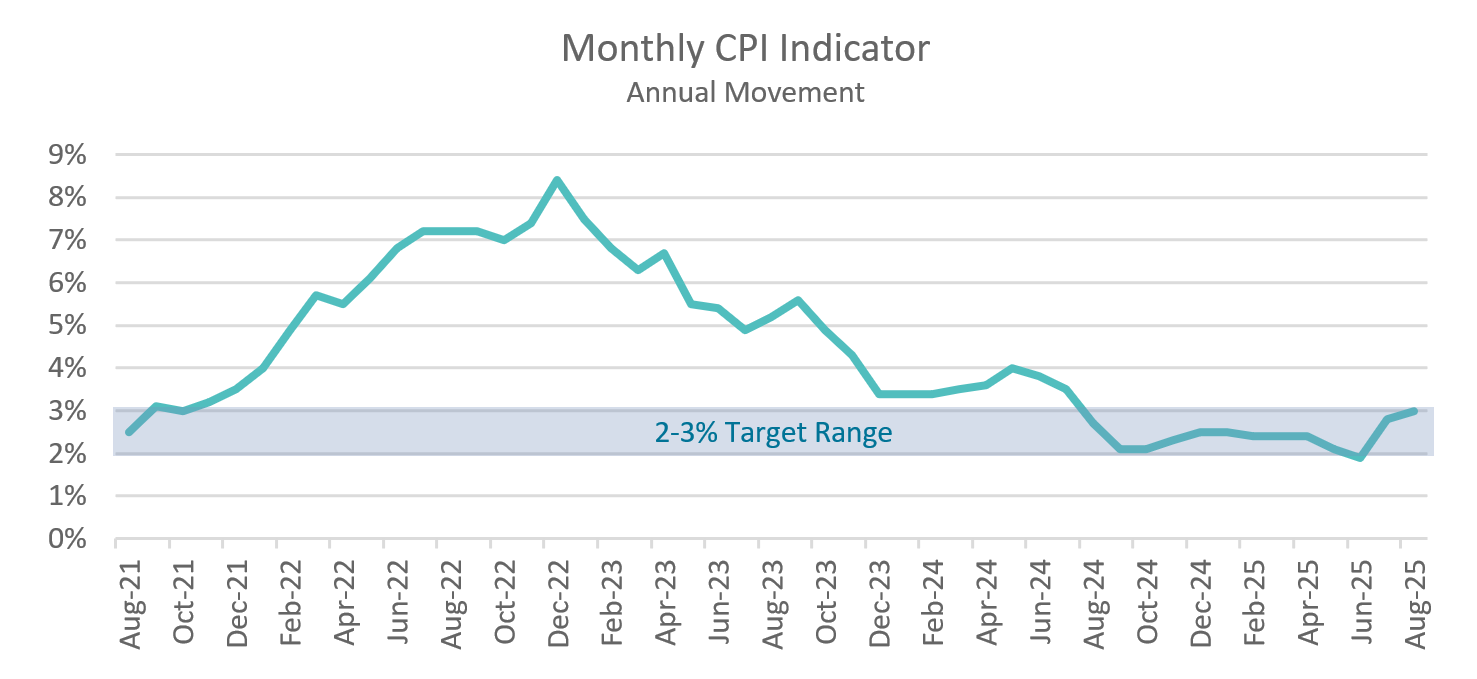

While inflation has eased significantly from its 2022 peak, the monthly CPI indicator rose to 3% in August. Whilst still on the cusp of the 2-3% RBA target range, this marked the highest annual rate since July 2024. The RBA acknowledged that inflation remains elevated, and the latest data did not warrant any further loosening as a result. The recent volatility suggests that the September quarter could remain elevated.

The uptick was largely driven by:

- Housing costs up 4.5%, with electricity prices surging 24.6% due to the expiry of the state government rebates;

- Food and non-alcoholic beverages up 3%; and

- Alcohol and tobacco up 6%.

The RBA remains committed to their primary objective of achieving price stability and full employment, maintaining a cautious stance amid ongoing domestic and global risks. Household consumptions is showing signs of recovery, supported by rising incomes and easier financial conditions. The housing marketing is strengthening, and credit remains accessible for both businesses and households. The labour market is tight, with unemployment sitting at 4.2%. However, geopolitical tensions and trade uncertainties continue to pose external risks. The Board will closely monitor income data to guide future policy decisions.

Source: Reserve Bank of Australia, October 2025