The latest Bitcoin halving just occurred on 19 April 2024. This key event in the cryptocurrency’s supply mechanism is not only a testament to the ingenuity of Satoshi Nakamoto’s creation but also a pivotal moment that could shape the future trajectory of Bitcoin’s value and its acceptance in the broader financial landscape.

What is Halving?

Bitcoin halving is a fundamental event programmed into the cryptocurrency’s code, designed to occur approximately every four years. The event halves the reward that miners receive for verifying transactions and adding new blocks to the Bitcoin blockchain, thereby slowing the rate at which new Bitcoins are created.

Mimicking the extraction rate of precious resources like gold, this process is Nakamoto’s solution to creating a deflationary digital currency. The primary objective of halving is to control inflation. Unlike fiat currencies, where central banks can adjust supply based on economic needs, Bitcoin maintains a predictable issuance rate, making it a deflationary asset by design.

A History of Halves

Since its inception, Bitcoin has undergone three halvings:

- 28 November 2012: The mining reward was halved from 50 Bitcoins to 25 per block.

- 9 July 2016: The reward was further reduced to 12.5 Bitcoins.

- 11 May 2020: The latest halving brought the reward down to 6.25 Bitcoins.

The 19 April 2024 halving has decreased the reward to 3.125 Bitcoins. Each halving event has historically been followed by significant bullish trends in the Bitcoin market. However, investors should approach these correlations with caution.

Chart 1: Bitcoin price trends and halving points

Source: Bitcoin Halving Cycles, Tradingview.com, 2 March 2024

The Legitimacy and Adoption of Cryptocurrency

The cryptocurrency industry has matured significantly in recent years, with the development of regulatory and legal frameworks in major markets such as the US, UK, UAE, Canada, France, Germany, Hong Kong, Japan, Singapore, Spain, and Switzerland.

Australia is also on the verge of implementing licensing and custody rules. This regulatory progress reflects the market’s resilience and an ongoing pursuit of innovation, setting a foundation for a balanced approach that mitigates risk while fostering opportunity.

Clear regulatory guidance is becoming the cornerstone of renewed stability, vital for the sustainable growth of the sector and is driving crypto adoption by the largest financial institutions in the world.

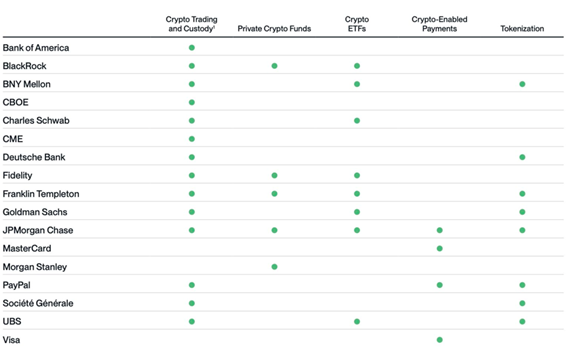

Chart 2: Crypto adoption by institutions

Source: Crypto Market Review Q4 2023, Bitwise Investments, January 2024

In the financial markets, this maturity is evident as Spot Bitcoin exchange-traded funds (ETFs) amassed net inflows of approximately $12.1 billion by the end of the first quarter of 2024. Remarkably, these gains were achieved in less than three months since the ETFs commenced trading on 11 January 2024. The introduction of these funds has been pivotal in boosting demand for Bitcoin, contributing to its price surges and setting new records.

A New Gold Standard?

Should Bitcoin replace gold or become a staple in traditional investment portfolios, its impact on price could be significant. At today’s prices, with the total market value of all gold estimated at over $15 trillion, and Bitcoin's market capitalisation at $1.25 trillion, the potential for growth is immense.

Conclusion

The increasing legitimacy of Bitcoin and cryptocurrencies, evidenced by clearer regulatory frameworks and their integration into traditional financial products like ETFs, signals that these digital assets are here to stay and destined for mainstream adoption. Bitcoin halving continues to be a critical event within the crypto landscape, shaping both market dynamics and the broader financial narrative, ensuring Bitcoin’s role as a significant player in the future of global finance.

Note: This article is neither financial advice nor an endorsement or recommendation to purchase or invest in Bitcoin or in any cryptocurrency and /or the use of any platforms they may be associated with. Crypto assets are unregulated and highly speculative. You risk losing some or all of your capital. There is no or limited consumer protection at this time.

Until next month,

Calvin Ng

Managing Director

Important information

This information is for accredited, qualified, institutional, wholesale or sophisticated investors only and is provided by Aura Group and related entities and is only for information and general news purposes. It does not constitute an offer or invitation of any sort in any jurisdiction. Moreover, the information in this document will not affect Aura Group’s investment strategy for any funds in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Aura Group makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this information. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. You should not construe any such information or any material, as legal, tax, investment, financial, or other advice. This information is intended for distribution only in those jurisdictions and to those persons where and to whom it may be lawfully distributed. All information is of a general nature and does not address the personal circumstances of any particular individual or entity. The views and opinions expressed in this material are those of the author as of the date indicated and any such views are subject to change at any time based upon market or other conditions. The information may contain certain statements deemed to be forward-looking statements, including statements that address results or developments that Aura expects or anticipates may occur in the future. Any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected in the forward-looking statements. This information is for the use of only those persons to whom it is given. If you are not the intended recipient, you must not disclose, redistribute or use the information in any way.

Aura Group subsidiaries issuing this information include Aura Group (Singapore) Pte Ltd (Registration No. 201537140R) which is regulated by the Monetary Authority of Singapore as a holder of a Capital Markets Services Licence, and Aura Capital Pty Ltd (ACN 143 700 887) Australian Financial Services Licence 366230 holder in Australia.